🎧 Deep Dive Audio - a two-host debate on LTH vs STH (Liquidity Pressure Model)

Who Really Controls the Price (And How to Track Them)

Most traders obsess over price. They draw trendlines, watch indicators, and miss the only variable that actually matters: who holds the coins.

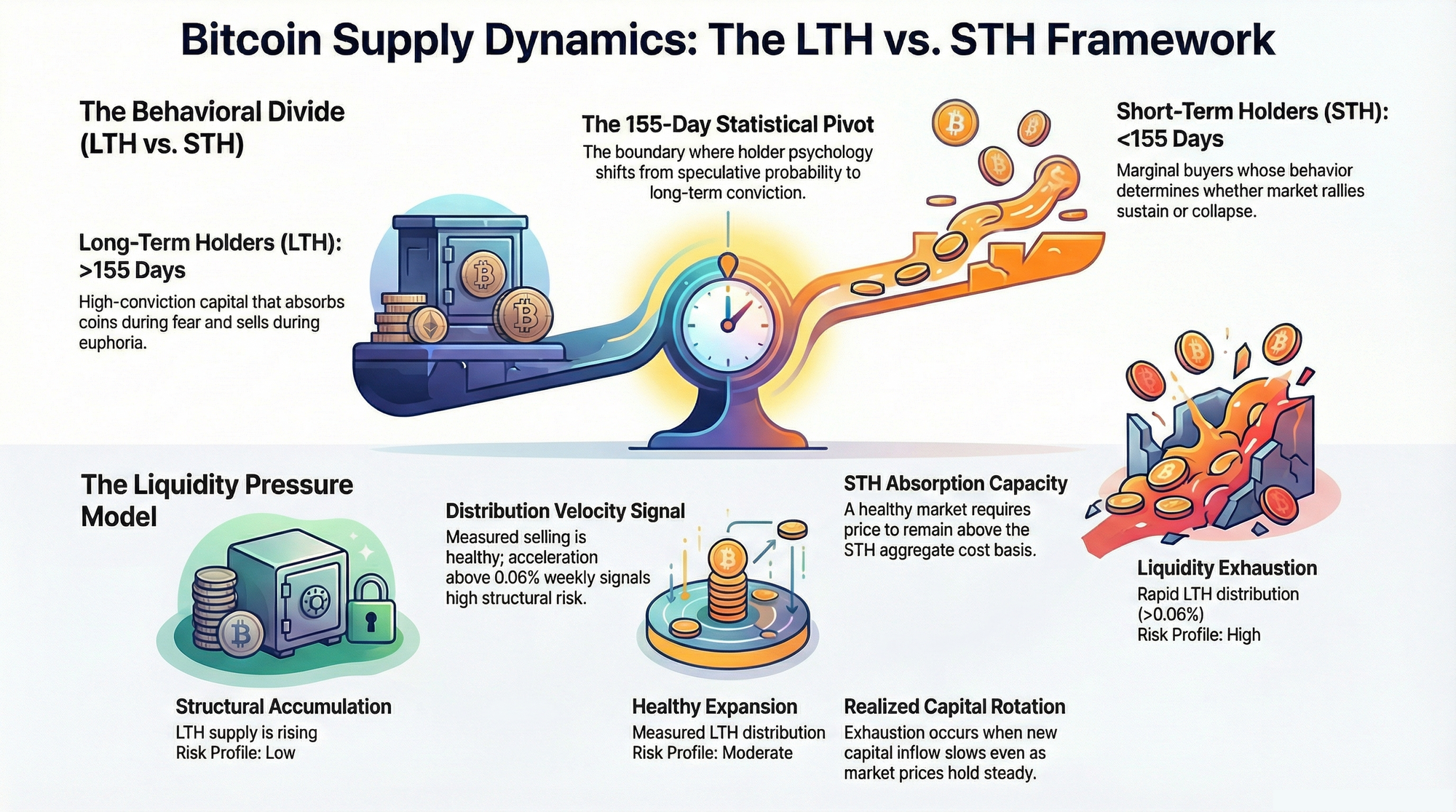

Bitcoin is not moved by candles. It is shaped by a continuous wealth transfer between two psychological cohorts: Short-Term Holders who chase momentum, and Long-Term Holders who structure supply. Understanding this dynamic is not optional for serious market participants-it is the foundation upon which all other on-chain analysis rests.

This guide does not simply define LTH and STH. It introduces a diagnostic framework-the Liquidity Pressure Model-designed to detect structural risk, not narrative sentiment. By the end, you will understand how to read the silent war between conviction capital and speculative flows, and why this single framework connects every major on-chain metric from MVRV to SOPR to Realized Price.

What Defines Long-Term Holders and Short-Term Holders?

The distinction between Long-Term Holders (LTH) and Short-Term Holders (STH) represents the most fundamental segmentation in Bitcoin on-chain analysis. This is not arbitrary categorization-it reflects empirically observed behavioral probability derived from blockchain data.

Long-Term Holders are addresses whose coins have remained unspent for more than 155 days. These entities statistically exhibit low probability of spending and represent long-duration conviction capital. They are the structural backbone of Bitcoin supply-the cohort that absorbs coins during fear and releases them during euphoria.

Short-Term Holders are addresses whose coins have remained unspent for less than 155 days. These entities statistically exhibit high probability of spending and are associated with speculative behavior. They represent the marginal buyer-the cohort whose behavior determines whether rallies sustain or collapse.

This cohort framework is not proprietary. It is widely adopted by institutional analytics providers including Glassnode, CryptoQuant, and Coin Metrics, each applying variations of the same underlying logic to model holder behavior.

The 155-Day Threshold: Why This Number?

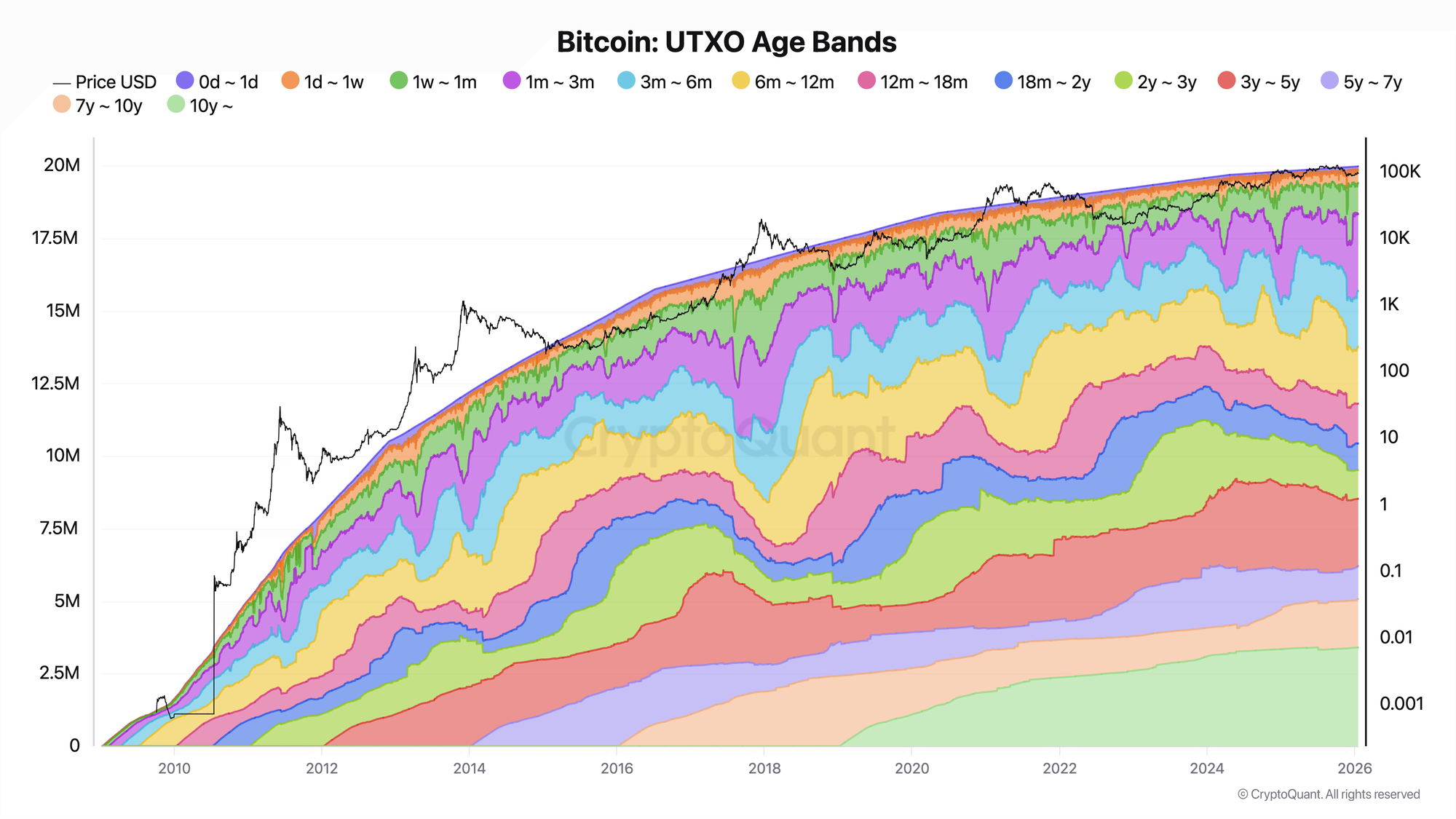

The 155-day threshold was formalized through survivorship analysis of the Bitcoin UTXO set. Researchers at Glassnode conducted extensive empirical work between 2019 and 2020, examining how coin spending probability changes as a function of holding duration.

The findings were consistent across multiple market cycles. Coins younger than approximately five months exhibit high spending probability-their holders are statistically likely to sell in response to price movements. Coins older than five months exhibit a sharp decay in spending probability. Beyond 155 days, the probability curve stabilizes at structurally low levels, indicating a behavioral shift from speculation to conviction.

This threshold is derived from observed behavioral probability, not arbitrary segmentation. It represents the statistical boundary where holder psychology demonstrably changes.

Data Architecture

All cohort-based metrics derive from raw blockchain primitives: Bitcoin UTXO creation time, UTXO spend time, coin age distribution, and price at time of last movement. This last element-price at movement-forms the basis of Realized Capitalization and enables cost basis analysis for each cohort.

The transparency of this data architecture is what makes LTH/STH analysis verifiable. Unlike sentiment indicators or survey-based metrics, cohort behavior is directly observable on the blockchain.

Structural Limitations You Must Understand

The cohort framework, despite its empirical foundation, introduces structural distortions that must be explicitly acknowledged.

Lost coin bias represents the most significant distortion. Permanently inaccessible coins-from early mining operations, lost keys, or the Satoshi stash-inflate LTH totals over time. These coins will never sell, yet they are counted as "Long-Term Holder supply." This creates a persistent upward drift in LTH metrics that has nothing to do with current market participants.

Exchange wallet restructuring creates noise in the data. When exchanges consolidate wallets or migrate to new custody solutions, internal operations can reset coin age without economic meaning. A coin moving from one exchange cold wallet to another is not distribution, but it may appear as such in raw metrics.

Aging bias is perhaps the most subtle distortion. Late-cycle speculative buyers who simply fail to sell gradually migrate into LTH classification without any change in behavioral conviction. A buyer at $60,000 who is underwater and waiting becomes an "LTH" after 155 days, despite exhibiting none of the conviction behavior associated with true long-term holders.

The conclusion is critical: LTH and STH metrics must be interpreted using rates of change, not absolute levels. Delta analysis eliminates much of the noise from structural distortions.

The Liquidity Pressure Model: A Diagnostic Framework

Most frameworks describe behavior. The Liquidity Pressure Model is designed to diagnose structural fragility.

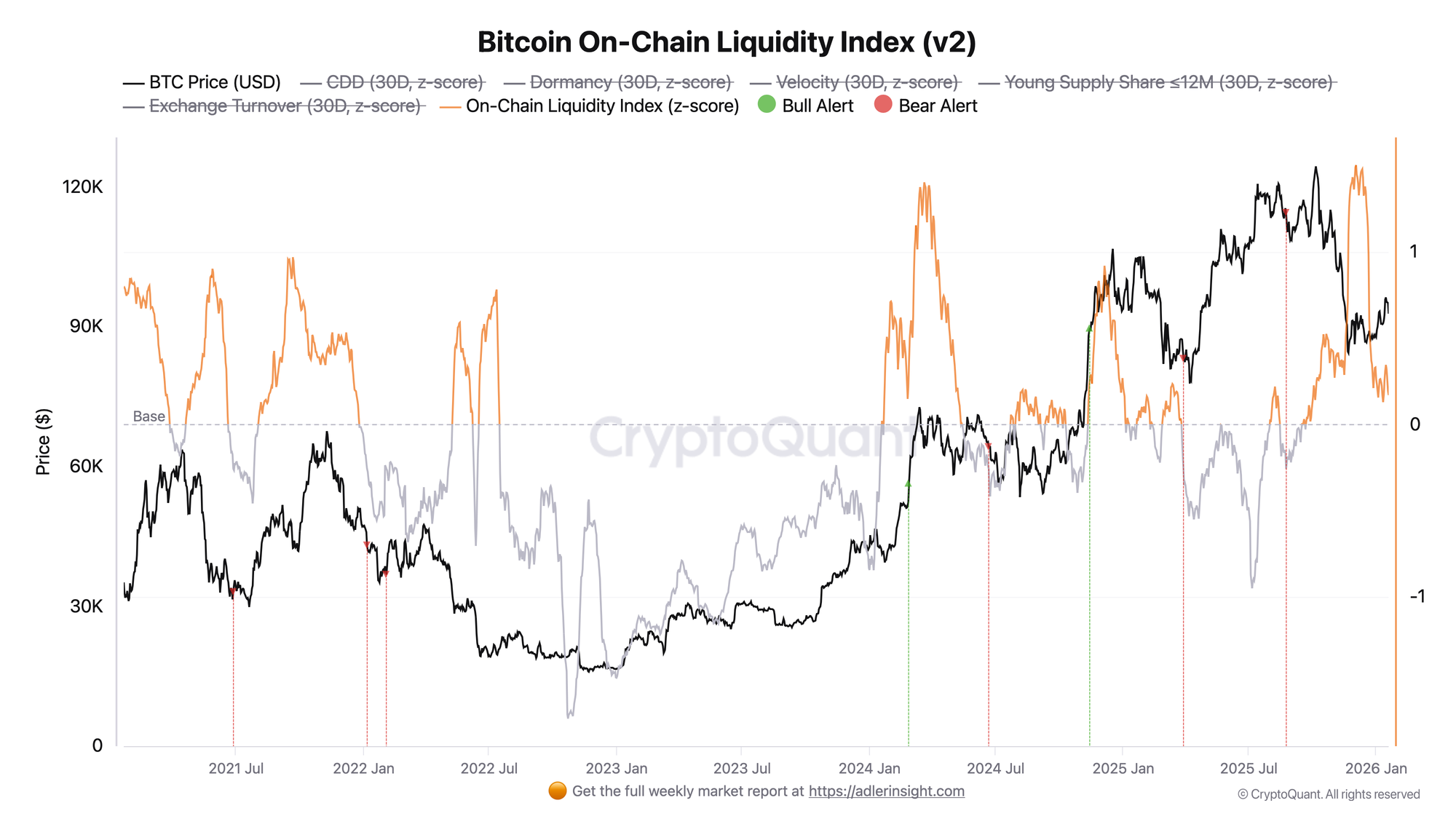

The model evaluates market state through three interacting variables: LTH distribution velocity, STH absorption stability, and realized capital rotation. Together, these components reveal whether a market is structurally sound or approaching exhaustion-regardless of what price is doing.

Component 1: LTH Distribution Rate

The first component measures the weekly change in LTH supply as a percentage of circulating supply. This is the velocity of conviction capital leaving the market.

Historical regime analysis reveals consistent patterns. During healthy expansion phases, LTH distribution runs between 0.03% and 0.05% weekly. This was observable in early 2017 and Q1 2021-periods where prices rose sustainably because distribution was measured and absorption was healthy.

During exhaustion phases, LTH distribution accelerates to 0.06% to 0.10% or higher weekly. This characterized Q4 2017 and Q4 2021-periods that preceded major structural tops. The key insight: selling by Long-Term Holders is normal and expected during bull markets. Acceleration of selling velocity is the risk signal.

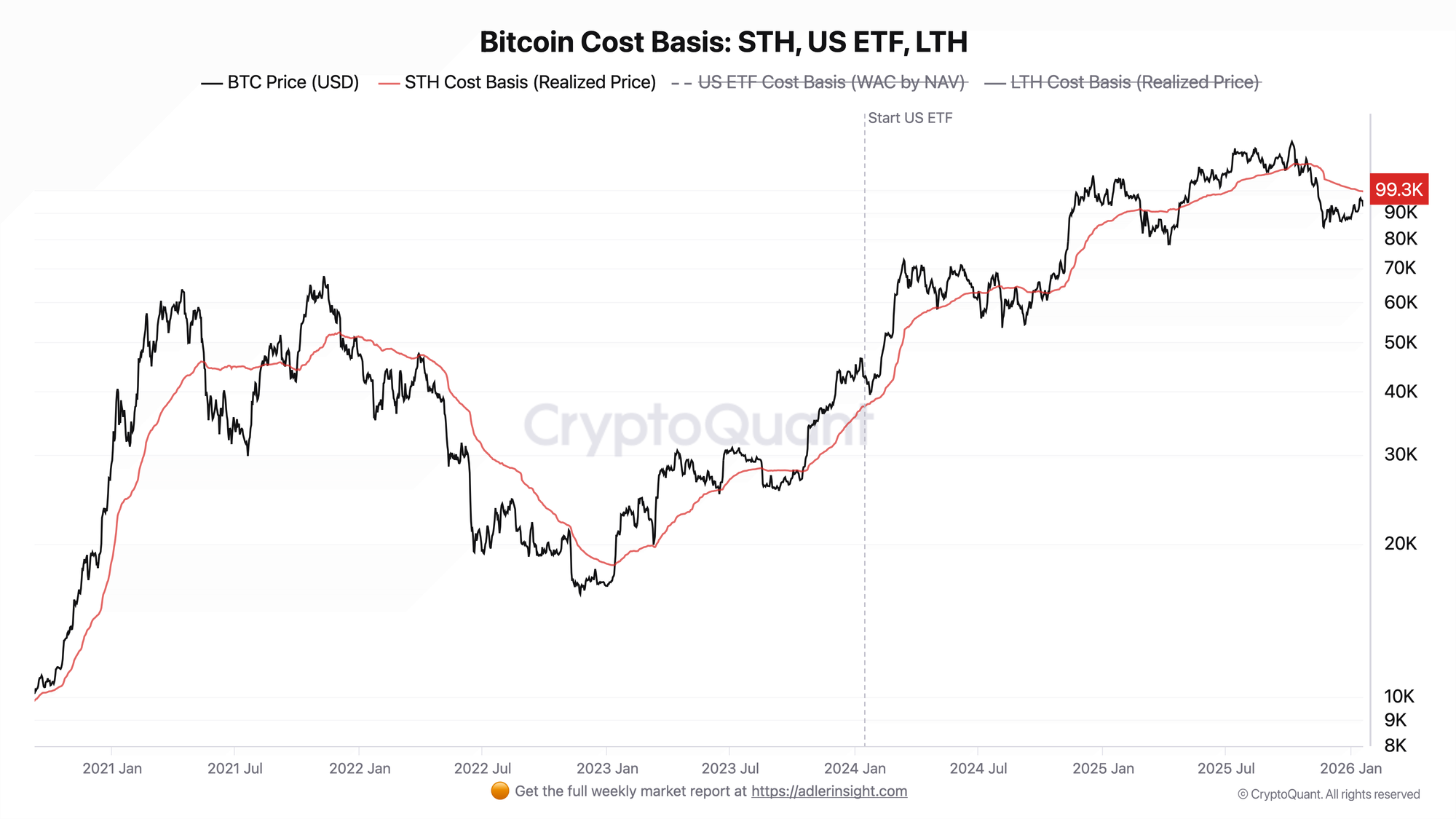

Component 2: STH Absorption Capacity

The second component evaluates whether new entrants can absorb the supply being distributed. This is measured through price relative to STH Realized Price and the behavior of STH-SOPR after drawdowns.

Healthy market structure exhibits specific characteristics. Price remains above STH Realized Price, meaning new buyers are in aggregate profit. SOPR resets above 1.0 after pullbacks, indicating that sellers are taking profits rather than realizing losses. Drawdowns remain contained under 20%.

Fragile market structure exhibits the opposite. Price repeatedly loses STH Realized Price, meaning new buyers are underwater. SOPR fails to recover above 1.0, indicating persistent loss realization. Drawdowns exceed 30% while STH supply continues growing-a sign that speculative buyers are trapped and absorbing losses.

Component 3: Realized Capital Rotation

The third component tracks where value is flowing between cohorts through their respective Realized Capitalizations.

During accumulation regimes, LTH Realized Cap rises while STH Realized Cap falls. This indicates coins are aging into long-term hands while speculative capital exits. Historical examples include 2018-2019 and Q4 2022 through Q1 2023.

During exhaustion regimes, STH Realized Cap peaks and then declines while price remains elevated. This divergence indicates that new capital inflow is slowing even as prices hold-the classic setup for structural tops. This characterized late 2017 and late 2021.

Regime Classification

The Liquidity Pressure Model identifies three primary market regimes.

Structural Accumulation occurs when LTH supply is rising, LTH Realized Cap is rising, and price trades near realized price bands. Risk profile is low. This is the optimal accumulation environment.

Healthy Expansion occurs when LTH distribution remains below approximately 0.05% weekly and STH absorption holds price above cost basis. Risk profile is moderate. This is sustainable bull market structure.

Liquidity Exhaustion occurs when LTH distribution exceeds 0.06% to 0.10% weekly, STH absorption fails, and STH Realized Cap declines while price remains elevated. Risk profile is high. This is the structural top setup.

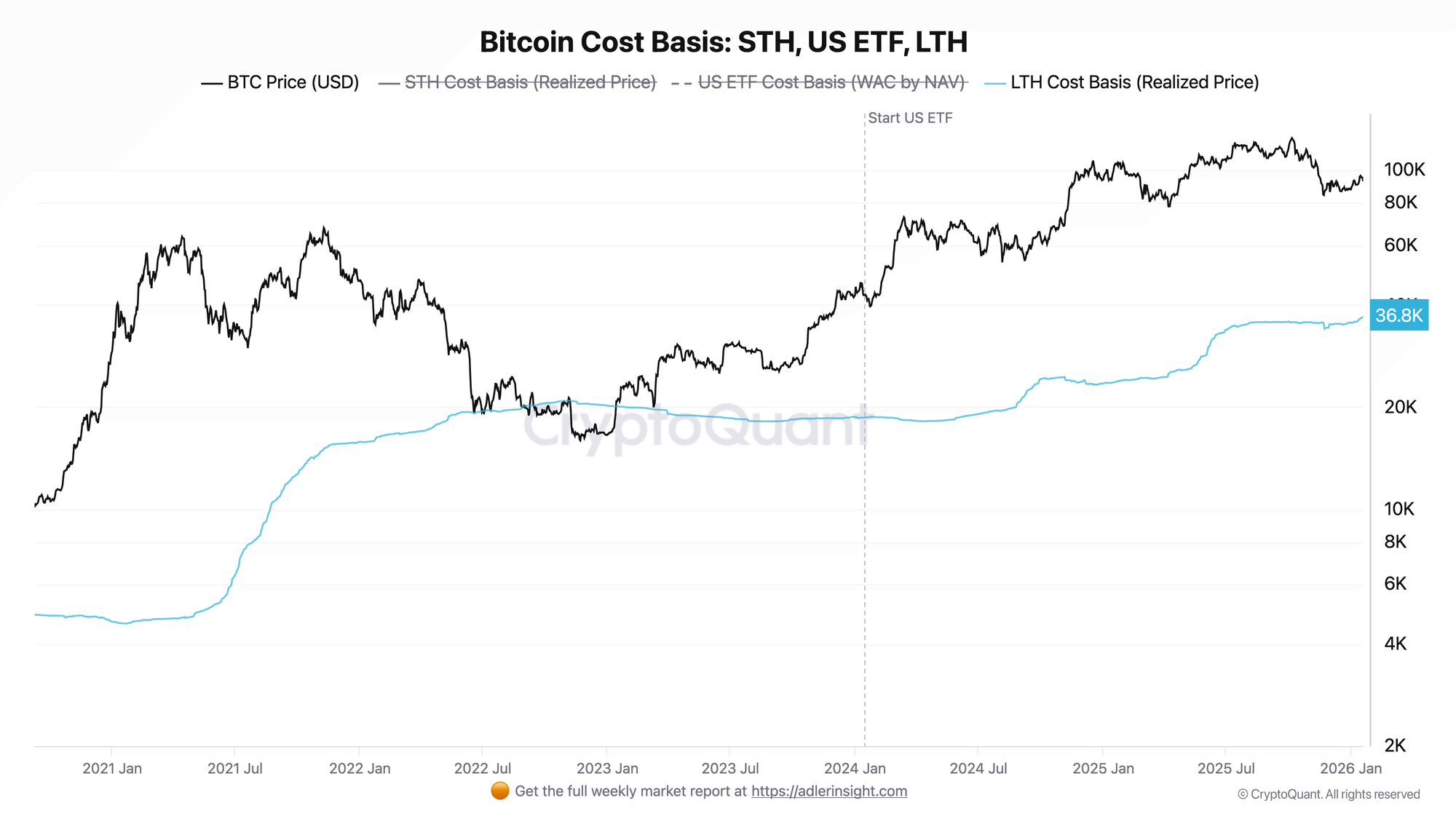

Cost Basis Analysis: The Critical Support Levels

Understanding cohort cost basis transforms abstract supply dynamics into actionable support and resistance levels.

STH Realized Price represents the aggregate cost basis of Short-Term Holders. During bull markets, this level acts as structural support-new buyers defending their positions creates natural demand. Loss of STH Realized Price historically marks regime breakdown, the transition from healthy expansion to distribution or bear market conditions.

LTH Realized Price represents the aggregate cost basis of Long-Term Holders. Because this cohort holds through cycles, their cost basis is significantly lower and moves slowly. Historically, price touching LTH Realized Price has aligned with generational bottoms-2015, 2018, 2022. These are the moments when even conviction capital is underwater, representing maximum capitulation.

The spread between these two levels provides regime context. Wide spreads indicate mature bull markets with significant unrealized profit in the system. Narrow spreads indicate accumulation phases or bear market compression.

How LTH/STH Connects to Other On-Chain Metrics

The LTH/STH framework is not isolated-it is the central node through which other on-chain metrics gain context.

MVRV (Market Value to Realized Value) measures aggregate profit in the system. But MVRV becomes far more diagnostic when decomposed into LTH-MVRV and STH-MVRV. Divergence between these readings reveals structural tension.

SOPR (Spent Output Profit Ratio) measures whether coins moving are in profit or loss. STH-SOPR specifically reveals the health of new buyer cohorts and their response to drawdowns.

NUPL (Net Unrealized Profit/Loss) aggregates unrealized gains across all holders. Cohort decomposition reveals whether profit is concentrated in conviction capital or speculative hands.

Realized Price itself is derived from the same UTXO data that powers cohort analysis. STH and LTH Realized Prices are simply filtered applications of the same methodology.

Supply in Profit/Loss quantifies how many coins are above or below their acquisition price. Cohort filtering reveals whether underwater supply is in strong or weak hands.

HODL Waves visualize the age distribution of the entire UTXO set, providing the raw material from which LTH/STH classifications are derived.

Every serious on-chain analysis ultimately connects back to this framework. Understanding LTH/STH dynamics is not one tool among many-it is the foundation.

Common Mistakes and Misinterpretations

Several analytical errors consistently appear in LTH/STH analysis.

Treating LTH selling as inherently bearish is the most common mistake. Long-Term Holders selling is the mechanism by which bull markets are funded. New demand must be met with supply, and that supply comes from LTH distribution. The signal is not direction-it is velocity. Measured distribution is healthy; accelerating distribution is the warning.

Using absolute LTH levels instead of delta ignores the structural distortions discussed earlier. Lost coins, aging bias, and exchange operations all contaminate absolute readings. Rate of change analysis filters much of this noise.

Isolating LTH/STH without exchange flow context leads to false inference. Distribution that moves to exchanges has different implications than distribution that moves to cold storage. Combining cohort analysis with Exchange Netflow and Exchange Reserve data provides the full picture.

Assuming STH behavior is uniformly speculative misses nuance. Not all Short-Term Holders are retail speculators. Institutional buyers, ETF inflows, and treasury accumulation all initially classify as STH before aging into LTH. Context matters.

Frequently Asked Questions

Does LTH supply always decrease in bull markets?

Structurally yes, because bull markets are funded by LTH distribution to new entrants. However, the rate of decline determines market health. Slow, measured decline indicates sustainable expansion. Rapid decline indicates potential exhaustion.

What is the exact difference between LTH and STH?

The classification threshold is 155 days based on UTXO survivorship probability analysis. Coins unspent for more than 155 days are LTH; coins unspent for less than 155 days are STH. This threshold reflects empirically observed behavioral change, not arbitrary selection.

Which metric tracks whale behavior best?

LTH/STH tracks age-based conviction, not balance-based whale behavior. Large holders can be either LTH or STH depending on when they acquired. For balance-based analysis, combine cohort data with wallet size distribution metrics.

How do ETF flows affect LTH/STH dynamics?

ETF-held Bitcoin initially enters as STH classification when acquired, then ages into LTH status over time. This creates a new structural dynamic where institutional vehicles gradually absorb supply into long-term classification, potentially tightening available float more rapidly than in previous cycles.

Can this framework predict exact tops and bottoms?

No framework predicts exact inflection points. The Liquidity Pressure Model diagnoses structural risk and regime classification. It identifies when conditions favor exhaustion or accumulation, not precise timing. This is risk assessment, not prophecy.

Conclusion

The war between Long-Term Holders and Short-Term Holders is the fundamental dynamic that shapes Bitcoin market structure. Every rally is funded by LTH distribution; every crash is absorbed by LTH accumulation. Understanding this cycle-and more importantly, understanding how to measure its velocity and health-separates structural analysis from price speculation.

The Liquidity Pressure Model provides a diagnostic framework for reading this dynamic in real time. By tracking LTH distribution rate, STH absorption capacity, and realized capital rotation, market participants can assess structural risk independent of narrative and sentiment.

This is not about predicting the future. It is about understanding the present with clarity that most market participants lack. In a market driven by psychology and liquidity, that understanding is alpha.

This analysis connects directly to our coverage of [MVRV], [SOPR], [Realized Price], [NUPL], and [HODL Waves]. For applied examples using this framework, see our weekly market analysis in Adler Premium.