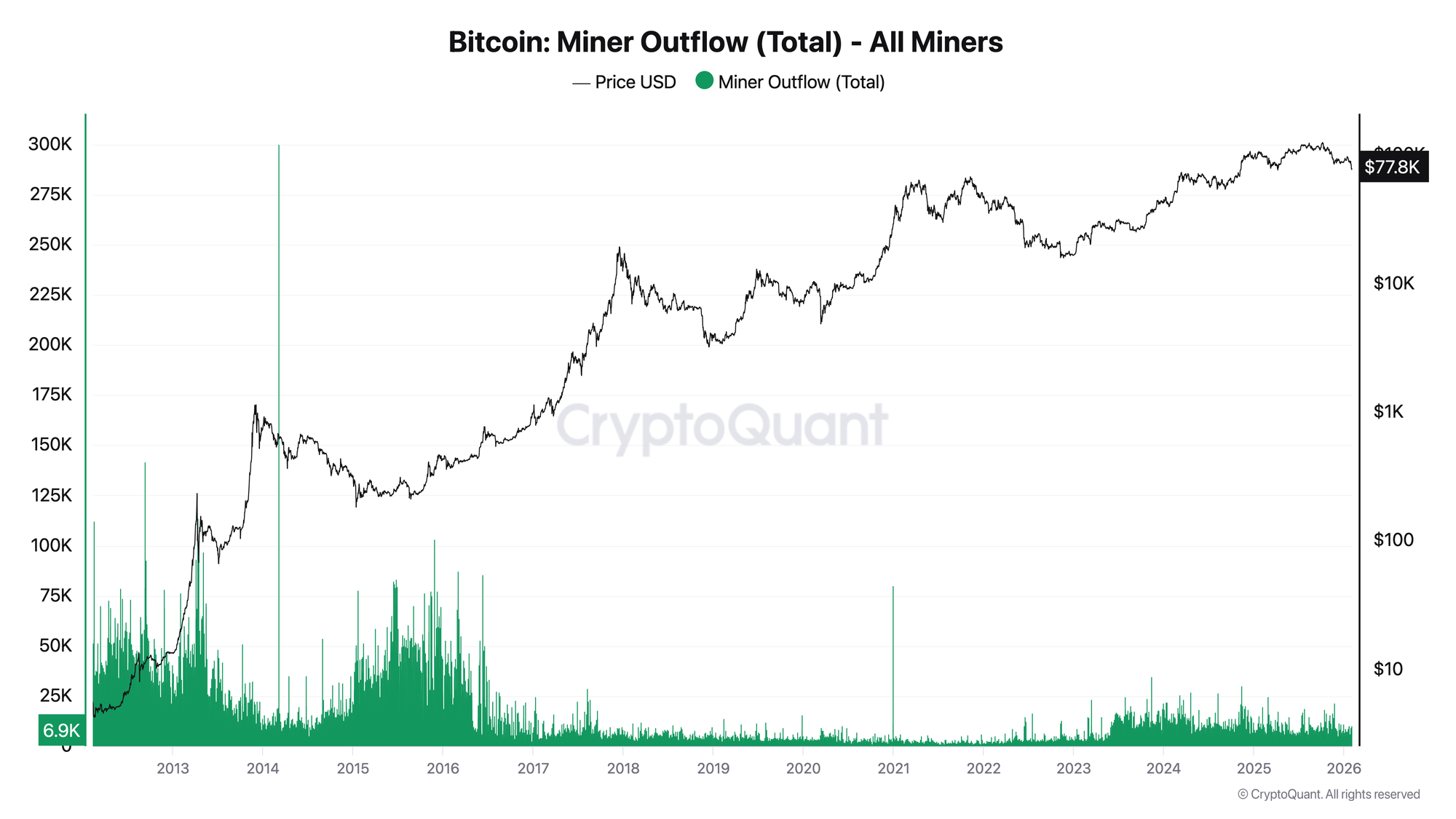

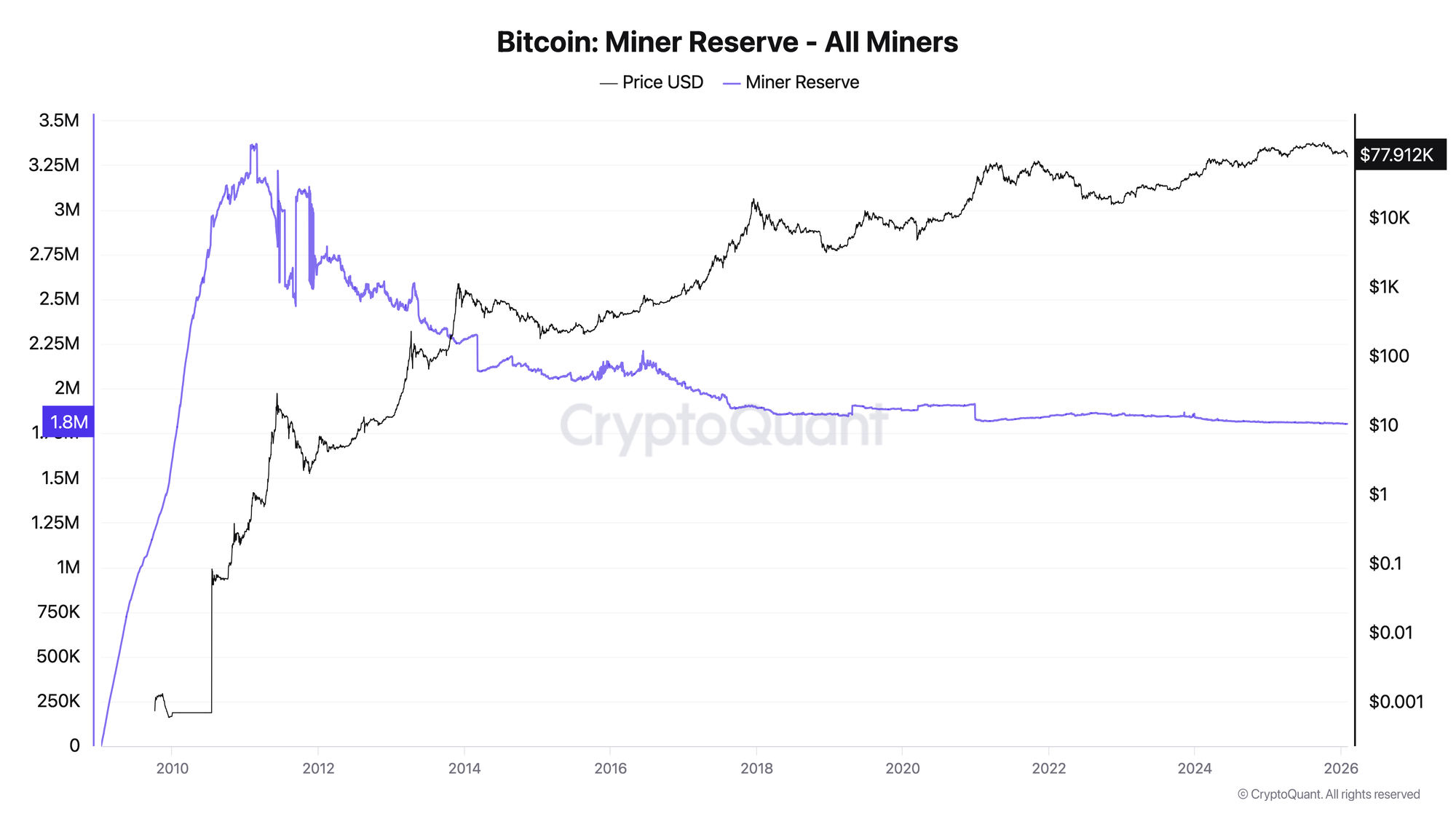

Bitcoin Miner Reserve and Miner Outflow are two core on-chain tools for measuring miners’ selling pressure: how much BTC miners hold in their wallets and how many coins leave miner wallets each day. When reserves are declining and daily outflows accelerate, the market is more likely to face additional supply that can weigh on price - especially during stress phases after sharp drawdowns or during distribution in overheated conditions. This guide provides practical interpretation rules, actionable thresholds (for example, >10K BTC/day as an alert zone), and a Puell Multiple framework to distinguish forced capitulation from routine profit-taking.

TL;DR

- Miner Reserve: Total BTC held in miner wallets (~1.80M BTC currently)

- Miner Outflow: Daily BTC transfers from miner wallets (average ~6,000 BTC/day)

- Bearish signal: Reserve declining + Outflow spikes >10,000 BTC = elevated selling pressure

- Bullish signal: Reserve stabilizing/rising + Outflow decreasing = accumulation

- Key insight: Miners sell most at cycle tops (profit-taking) AND bottoms (forced liquidation)

- Confirmation: Combine with Puell Multiple for context - low Puell + high outflow = capitulation; high Puell + high outflow = distribution

The Signal Rule

Miner Sell Pressure = 30-day Outflow Sum ÷ 30-day Average Reserve

Rule of thumb: Single-day outflows >10,000 BTC warrant attention. Multiple consecutive days >15,000 BTC signal capitulation or aggressive distribution.

Key Definitions

Miner Reserve: Aggregate BTC balance across all identified miner wallets (mining pools + solo miners). Declining reserve = net selling; rising = accumulation.

Miner Outflow: Daily BTC volume transferred OUT of miner wallets. Includes exchange deposits (selling) + internal transfers + OTC deals.

Miner Sell Pressure: Ratio comparing recent outflows to reserve levels (Capriole formula). Higher = more selling than usual.

MPI (Miners' Position Index): Outflow in USD ÷ 365-day MA of outflows. MPI > 1 = selling above yearly average.

How to Interpret

Bullish case: Reserve stabilizing or increasing after drawdown period. Outflows declining to <5,000 BTC/day. Miners confident in higher prices - holding production instead of selling.

Bearish case: Reserve declining consistently (multi-week trend). Outflow spikes >10,000 BTC. Context determines meaning:

- If Puell > 2.0: Profit-taking distribution (cycle top)

- If Puell < 0.5: Forced capitulation (potential bottom)

Neutral case: Reserve flat, outflows averaging 5,000–7,000 BTC/day. Normal operational selling to cover costs.

What matters most: Trend over 2–4 weeks, not single-day spikes. Combine with Puell Multiple to distinguish distribution vs capitulation.

Historical Examples

Example 1: November 2025 Capitulation

Setup: BTC corrected from $115K ATH, Hash Ribbons signaled capitulation.

What the data showed:

- Nov 21, 2025: 21,579 BTC outflow (highest daily level in years)

- Nov 14: 16,638 BTC | Nov 4: 16,099 BTC

- Reserve declined from 1.807M → 1.803M BTC (Nov–Feb)

What happened: BTC fell from ~$85K to ~$78K. Miners under stress, forced to liquidate as hashprice collapsed.

Key insight: Multiple days >15K outflow + declining reserve + Hash Ribbons capitulation = confirmed miner stress.

Example 2: 2024 Post-Halving Drawdown

Setup: April 2024 halving cut block rewards 50%. Miners' revenue halved overnight.

What the data showed:

- Reserve declined from 1.843M (Jan 2024) → 1.811M BTC (Jan 2025)

- ~32,000 BTC drawn from reserves over 12 months

- Gradual, consistent selling rather than panic spikes

What happened: BTC rallied from $40K to $115K despite miner selling - ETF demand absorbed supply.

Key insight: Gradual reserve decline isn't bearish if demand (ETFs, institutions) absorbs selling.

Example 3: Current Status (Feb 2026)

- Reserve: 1.803M BTC (−4K from Jan 2026)

- Recent outflows: 6,000–10,000 BTC/day range

- Trend: Moderate selling, not panic levels

- Context: Hash Ribbons capitulation active, Puell at 0.6–0.8

Interpretation: Miners still under pressure but not in extreme capitulation. Watch for reserve stabilization as recovery signal.

How to Use It in Practice

Setup: Monitor Miner Reserve and Outflow via CryptoQuant or Glassnode.

Trigger: Outflow spikes >10,000 BTC/day for 3+ consecutive days.

Confirm with:

- Puell Multiple for profitability context

- Hash Ribbons for capitulation status

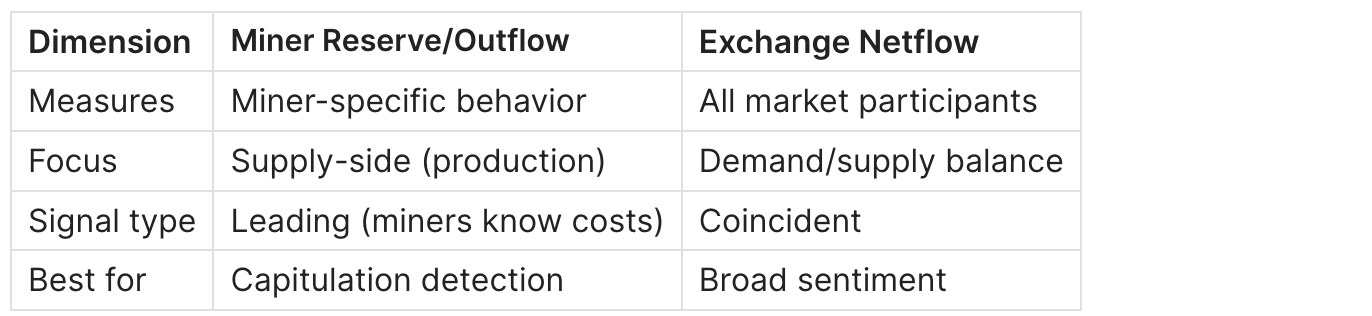

- Exchange Netflow for broader selling pressure

Invalidates when: Reserve stabilizes, outflows return to <7,000 BTC/day.

Action:

- High Puell + high outflow = reduce exposure (distribution phase)

- Low Puell + high outflow = monitor for bottom (capitulation phase)

Common Pitfalls

1. Confusing outflows with selling

Not all outflows are sales. Includes internal transfers, cold storage moves, OTC deals. Look for exchange-specific inflows as confirmation.

2. Ignoring demand context

2024 showed miners can sell consistently while price rises if ETF/institutional demand absorbs supply. Reserve decline ≠ automatic bearish.

3. Overreacting to single spikes

One day of 15K outflow may be whale miner rebalancing. Look for multi-day patterns.

4. Missing the Puell context

High outflow + Puell > 2 = distribution (bearish)

High outflow + Puell < 0.5 = capitulation (potentially bullish reversal setup)

5. Not tracking reserve levels

Outflow alone is noisy. Reserve trend provides cleaner signal of net accumulation/distribution.

Miner Reserve vs Exchange Netflow

Combined use: Miner outflow increasing + Exchange netflow negative (inflows) = double selling pressure.

FAQ

What's a "normal" daily outflow?

3,000–7,000 BTC/day is typical operational selling. >10,000 BTC warrants attention; >15,000 BTC is elevated.

Why do miners sell at both tops and bottoms?

Tops: Profit-taking when prices are high. Bottoms: Forced selling to cover costs when revenue < expenses.

Where to track Miner Reserve/Outflow?

CryptoQuant, Glassnode, TradingView (Miner Sell Pressure indicator by capriole_charles).

What's the current miner reserve?

~1.803M BTC as of February 2026, down from 1.856M peak in 2023.

How does halving affect miner behavior?

Post-halving, miners face 50% revenue cut → increased selling pressure for 6–12 months as inefficient miners exit.

Does this work post-ETF?

ETF demand can absorb miner selling. Check exchange netflows alongside miner data for full picture.

Related Guides

- Bitcoin Puell Multiple: Definition, Formula & Miner Signals - Miner profitability cycles

- Bitcoin Exchange Netflow: What It Is and How to Use It - Broader flow analysis

- Bitcoin Hash Ribbons: Capitulation Signals - Hashrate-based confirmation

Conclusion

- Miner Reserve (~1.80M BTC) + Outflow (avg ~6K BTC/day) reveal supply-side selling pressure

- Spikes >10K BTC/day = elevated; >15K = extreme. Always check Puell for context

- Current (Feb 2026): Moderate selling, reserve declining slowly - miners stressed but not panicking

Next step: Cross-reference with Puell Multiple to determine if current outflows signal capitulation or distribution.

Daily Analysis: Adler AM - Free weekly Bitcoin on-chain insights

Premium Research: Adler Premium - Institutional-grade reports

Disclaimer: Educational content only, not financial advice.