🎧 Morning Brief #106 - audio debate on today’s market setup

Over the past seven days, short-term market participants moved from capitulation to cautious recovery: SOPR broke above 1.0 from below, yet the MVRV metric within the 155-day range continues to signal a structural discount.

TL;DR

Short-term holders are realizing profits for the first time in a week - seller pressure is easing. However, MVRV remains deeply below the norm, and the durability of the reversal has yet to be confirmed.

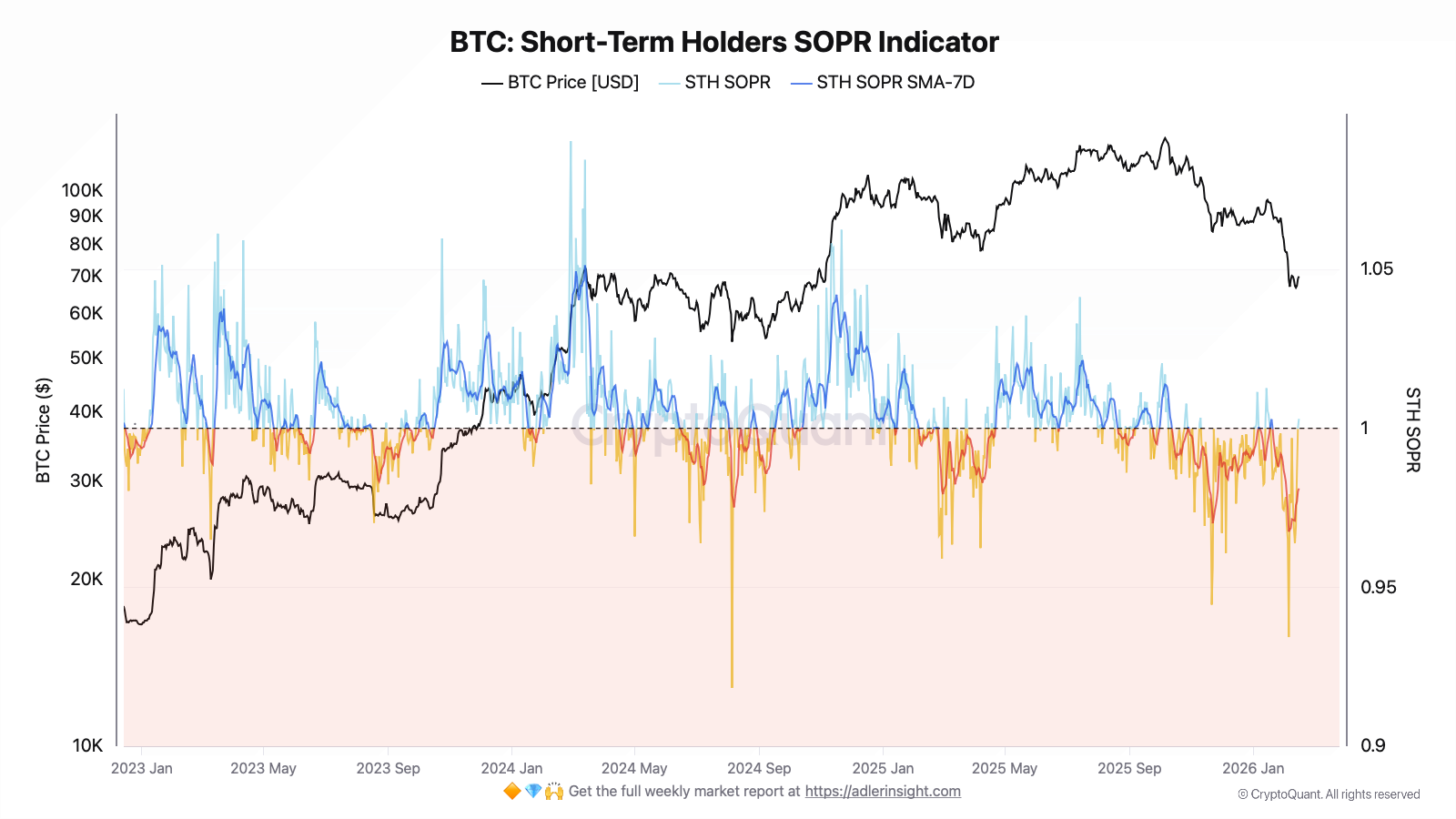

Bitcoin Short-Term Holders SOPR Indicator

SOPR (Spent Output Profit Ratio) for short-term holders: a value below 1.0 means coins are being sold at a loss.

Over the past seven days, the STH SOPR completed a full cycle from a local trough to recovery. On February 11, the indicator hit a low of 0.9639 - coins were being sold at an average loss of approximately 3.6% - while the 7-day moving average fell to 0.9709. By February 15, the daily SOPR had returned above 1.0 (1.0030) and the SMA7 recovered to 0.9811. The local reversal occurred as price recovered from $66,928 to $70,154.

The daily SOPR crossing back above 1.0 is the first positive signal of the week: short-term sellers have stopped selling at a loss. The SMA7, however, remains below 1.0, indicating persistent pressure on a weekly basis. The key confirmation trigger for a regime change is the SMA7 holding above 1.0 for at least several consecutive days.

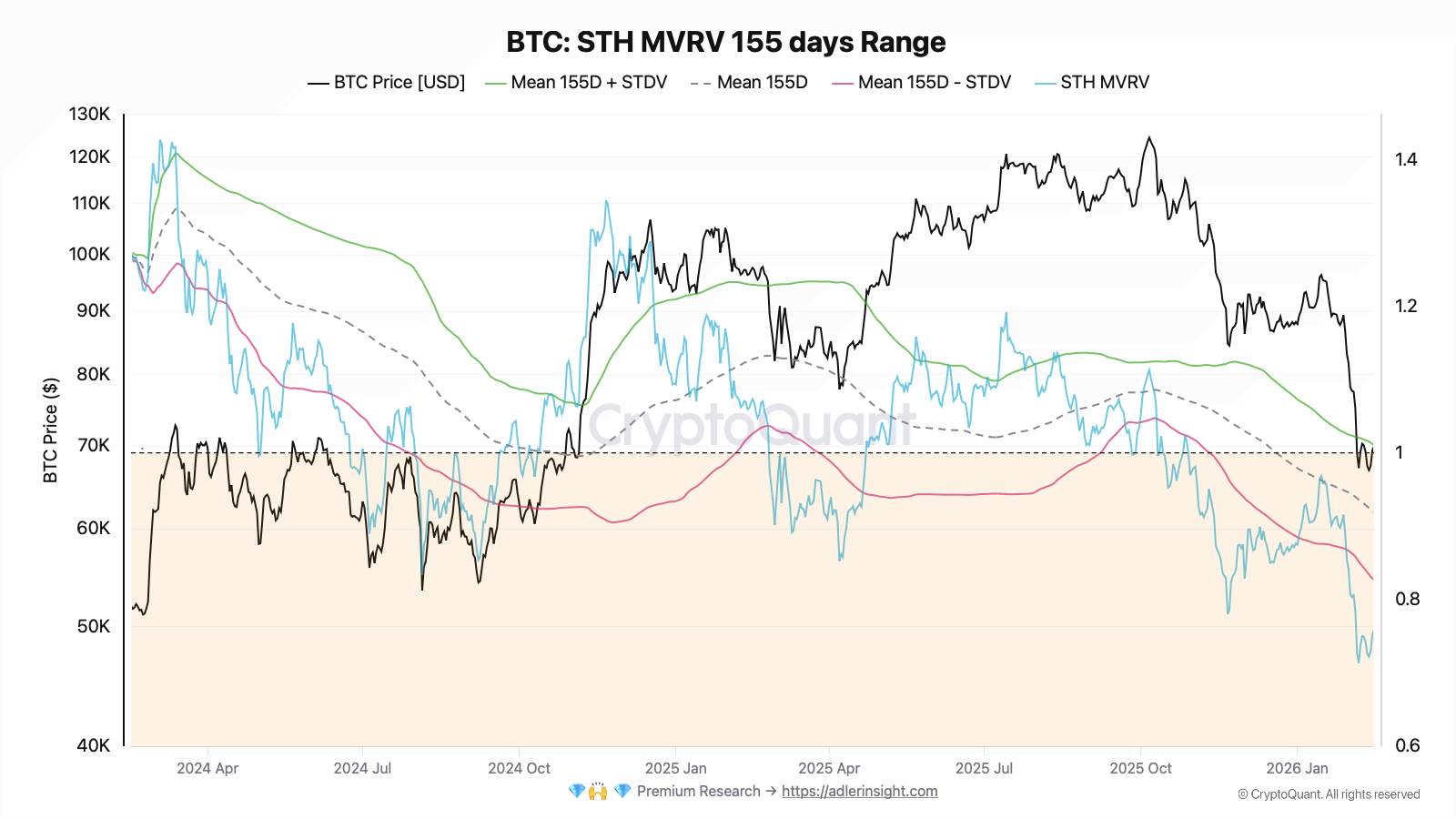

Bitcoin STH MVRV 155-Day Range

STH MVRV: the ratio of market value to realized value for short-term holders; a reading below the mean indicates the cohort is on average "underwater" relative to their cost basis.

The STH MVRV metric recorded a low of 0.7222 on February 12 - approximately 12% below the lower boundary of the normal range (-1 standard deviation, ~0.827). By February 15, the reading had recovered to 0.7586, yet it remains 17% below the 155-day mean (0.919) and more than 8% below the lower band boundary. For reference, the neutral zone sits at approximately 0.919-1.010, and the current value has not yet reached even the lower boundary (-1 standard deviation).

Historically, MVRV below -1 standard deviation corresponds to oversold zones, where short-term holders collectively carry unrealized losses. This implies that on any rally attempt, a significant portion of this cohort will use bounces to exit at breakeven, creating a supply overhang. The key level to watch is a MVRV recovery above the lower band boundary (~0.827): only then will structural pressure begin to ease.

Both indicators paint the same picture: the daily SOPR has recovered, suggesting a reduction in immediate panic selling, yet MVRV on the 155-day horizon remains deeply in deficit - this is a structural signal, not a tactical one. Tactical pressure has eased; the structural imbalance persists.

Unlock the Weekly Playbook - free for 7 days.

One action. Clear triggers. Clear invalidation.

FAQ

What does SOPR above 1.0 mean if short-term holders are still at a loss according to MVRV?

SOPR measures the profitability of coins spent on a given day - that is, those who decided to sell. If SOPR has returned above 1.0, it means that active sellers are no longer selling at a loss; however, the majority of short-term holders who are simply holding their coins remain "underwater" - and that is precisely what MVRV reflects.

Under what conditions can we speak of a sustainable reversal in short-term holder positioning?

The minimum necessary conditions are: SMA7 SOPR holding sustainably above 1.0 (for at least 3-5 consecutive days) and MVRV recovering above the lower boundary of the 155-day range (~0.827). Until both conditions are met, the bounce should be treated as tactical rather than structural.

CONCLUSIONS

Short-term holders spent the past week under stress: SOPR fell to 0.9639 and MVRV hit a low of 0.7222 - both readings confirmed the capitulation-like nature of the decline to $66,928. By February 15, the daily SOPR returned above 1.0 and active seller pressure eased - a positive short-term signal. However, MVRV remains 17% below the 155-day mean and more than 8% below the lower norm, which maintains a structural supply overhang: every bounce will be met with selling from participants seeking to exit at breakeven. The current regime is neutral: tactical pressure has declined, but confirming a recovery requires seeing SMA7 SOPR above 1.0 and MVRV above ~0.827. The primary risk is a retest of $65K if price fails to hold above $68K and SMA7 SOPR turns lower.