Bitcoin short-term holders have been selling coins at a loss since October 13, 2025. The weekly average SOPR remains steadily below one, while a negative Z-Score forms a picture of active selling at a loss.

TL;DR

STH SOPR steadily below 1.0 with Z-Score at -0.58 — short-term holders are realizing losses. A return of SOPR above 1.0 will be the first signal of regime change.

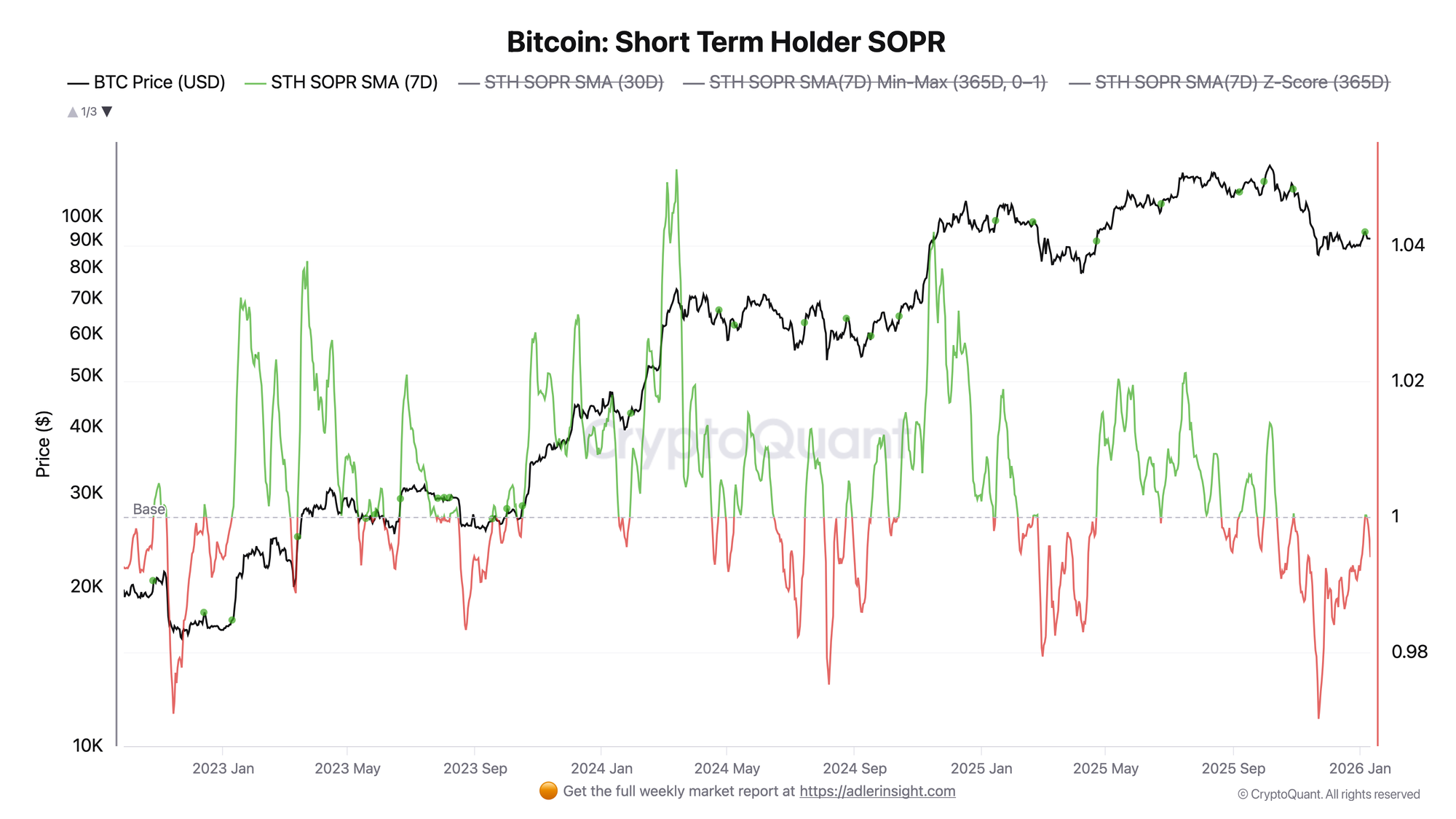

Bitcoin Short-Term Holder SOPR

The STH SOPR metric measures the ratio of selling price to purchase price for coins moved less than 155 days ago. A value below 1.0 means that short-term holders are, on average, selling cheaper than they bought.

As of January 11, STH SOPR (7D SMA) stands at 0.994, while the daily value dropped to 0.9817 - the lowest since the beginning of the year. Notably, there is technical confirmation of the regime: on January 8, the 7-day average crossed below the 30-day average (0.9996 → 0.9928), indicating a transition to a loss-dominant environment. The Z-Score at -0.58 means that SOPR values are below the annual average by approximately half a standard deviation - a zone historically associated with local bottoms.

Sustained SOPR below 1.0 creates pressure on investors and forces them to sell at a loss. The regime change trigger is the return of 7D SMA above 1.0 with confirmation via Z-Score rising into positive territory.

Every week I publish one SQL query with a full breakdown of the logic - from raw data to a finished indicator.

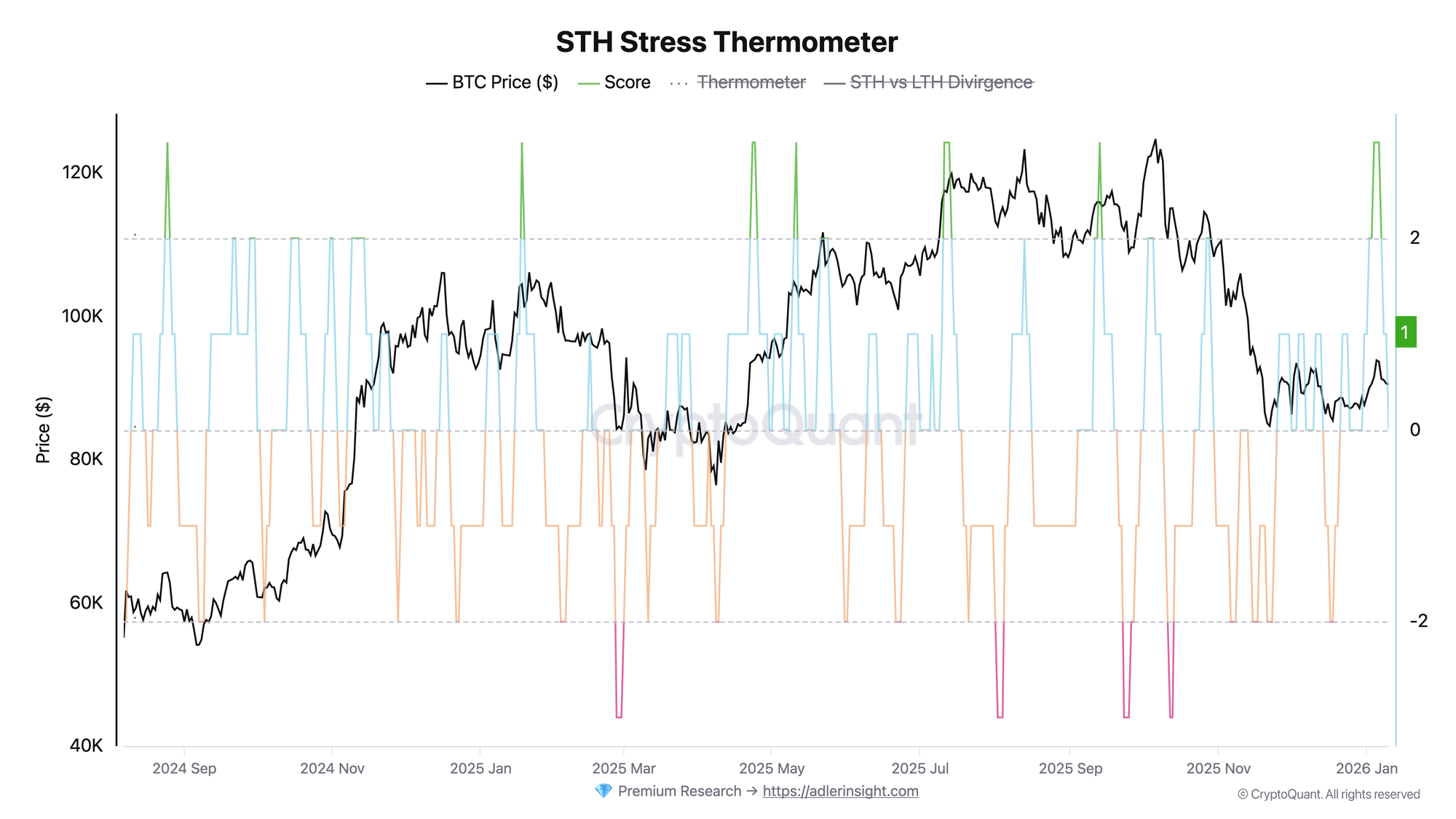

In the latest SQL of the Week 009: STH Stress Thermometer, we break down an indicator that measures how extreme the current condition of Short-Term Holders (STH) is relative to their recent baseline.

If you want to go beyond just looking at charts and actually understand where the numbers come from, this is for you.

→ 7-day free trial, cancel anytime with one click.

FAQ

How is STH SOPR connected to Bitcoin price movement?

STH SOPR reflects the behavior of short-term participants who are most sensitive to volatility. When price declines, SOPR moves below 1.0 as recent buyers realize losses. A return of SOPR above 1.0 often coincides with local reversals, as forced selling pressure eases and the market transitions into a more constructive phase.

What SOPR levels will signal a regime change?

The first signal is a sustained return of 7D SMA above 1.0 over 3-5 days. Confirmation comes from 7D SMA crossing up through 30D SMA. A strong bullish signal is Z-Score above +0.5 with SOPR > 1.02.

CONCLUSIONS

The market is in a redistribution phase with clear quantitative characteristics: STH SOPR at 0.994 (7D SMA), Z-Score at -0.58, and RPL Ratio at 0.68 form a consistent picture of short-term position washout, where participants are exiting the market en masse at a loss. The main trigger for transitioning to risk-on mode is the return of SOPR 7D SMA above 1.0 with confirmation through Z-Score growth. The key risk is a deepening correction if Z-Score falls below -1.0, which would shift the market into capitulation mode.