🎧 Morning Brief #0099 - audio debate on today’s market setup

Bitcoin crashed to $71K, dragging short-term holders deep into loss territory. Both on-chain indicators - SOPR and MVRV - confirm the market has entered a phase of forced selling with loss realization.

TL;DR

Short-term holders are realizing losses and sitting on average 25% below their cost basis.

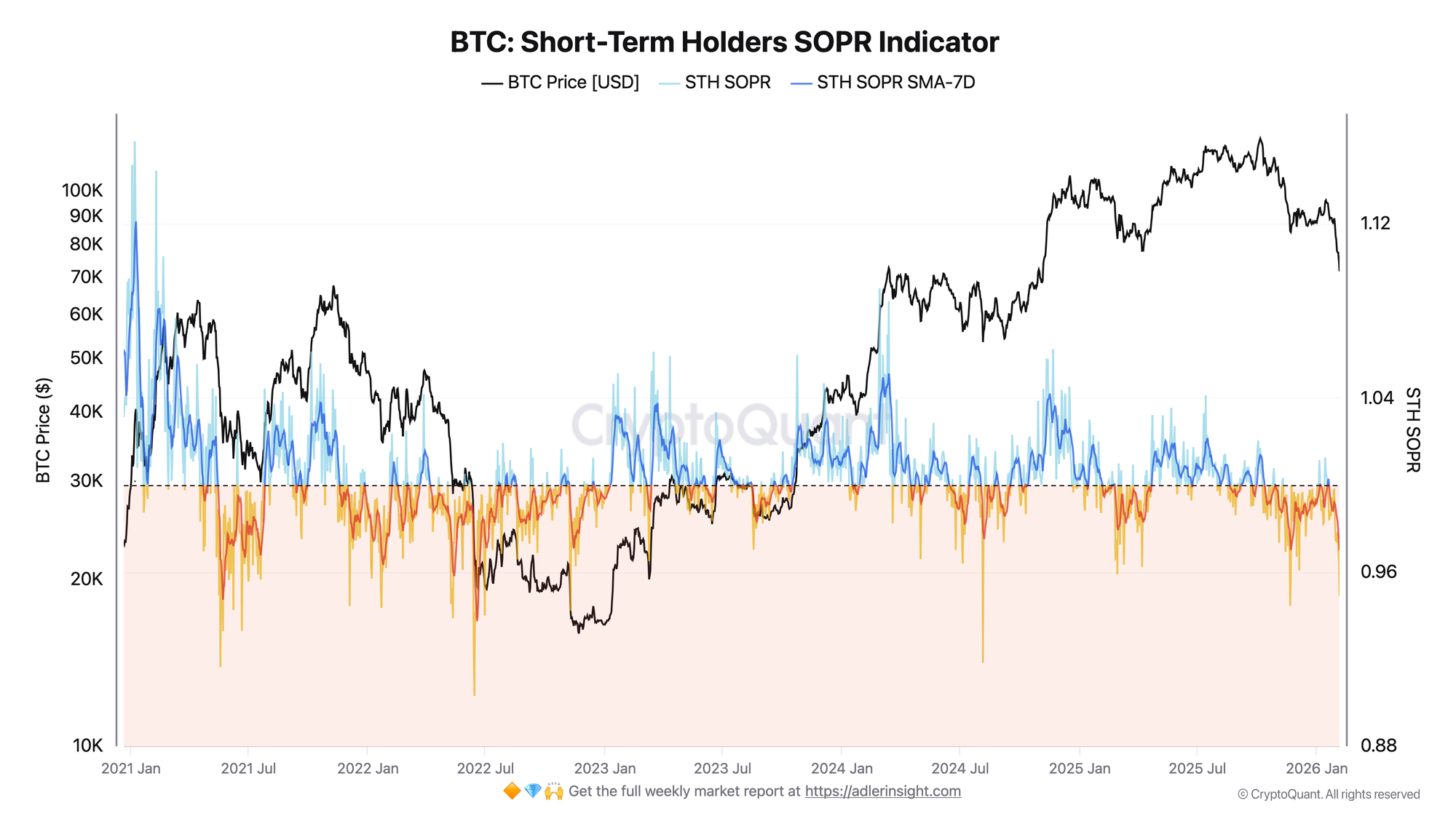

Bitcoin Short-Term Holders SOPR

SOPR measures the ratio of realized price to acquisition price for coins held by short-term holders. A value below 1.0 means holders are selling at a loss.

STH SOPR dropped to 0.949, while the 7-day average sits at 0.97 - both values firmly below the critical 1.0 level. This means short-term participants are realizing an average 5% loss on each sale. Since mid-January, the indicator has not risen above one, pointing to sustained pressure from forced liquidations.

Continued SOPR below 1.0 alongside price stabilization is a classic signal of seller exhaustion. A return of SOPR above 1.0 will be the first sign of regime change and a potential bottom. Until then, the risk of continued decline prevails.

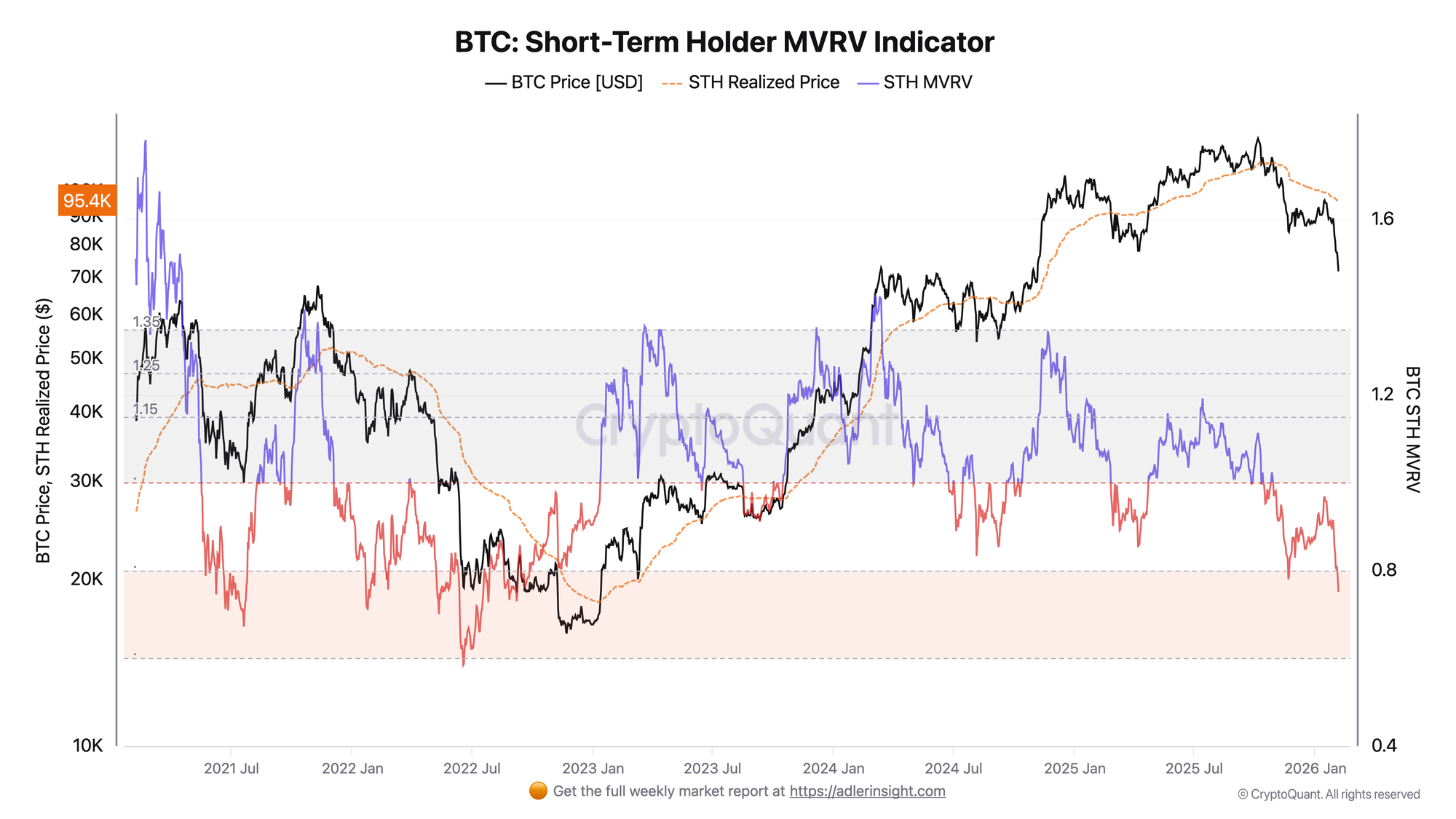

Bitcoin Short-Term Holder MVRV

MVRV compares the current price to Realized Price - the average purchase price of the cohort. A value below 1.0 means the entire cohort is sitting in a loss on average.

STH MVRV crashed to 0.752 with Realized Price around $95.4K - this means short-term holders are on average 25% underwater. The current level is approaching the extreme zone of 0.8, which has marked local bottoms. The gap between market price ($71.7K) and STH cost basis ($95.4K) reached $23.7K - the widest this cycle.

MVRV confirms the SOPR signal: the market is in short-term holder capitulation mode. Historically, MVRV values below 0.8 corresponded to accumulation zones, but price stabilization and SOPR reversal are required to confirm bottom formation.

Headlines don’t tell you what to do.

The market is noisy and contradictory. Our system converts raw data into a clear weekly action - BUY, HOLD, REDUCE, or EXIT.

FAQ

What does MVRV 0.75 mean for short-term holders?

This means STH are sitting on average at a 25% loss from their cost basis. At this level of drawdown, the probability of forced selling and emotional exits increases.

What signal will confirm a reversal?

The key trigger is STH SOPR returning above 1.0 with stable or rising price. This will show that sellers no longer dominate and new buyers are ready to absorb supply. Additional confirmation would be MVRV turning up from current levels and the spread between price and Realized Price narrowing.

CONCLUSIONS

Both indicators point to a phase of elevated stress for short-term holders: SOPR at 0.95 confirms loss realization, while MVRV at 0.75 shows the depth of drawdown relative to cost basis at 25%. The current regime is risk-off with forced selling prevailing. Historically, such levels have formed accumulation zones, but SOPR returning above 1.0 is required to confirm a bottom. The main risk is a continued liquidation cascade on a break of psychological levels, which could push MVRV toward the extreme zone of 0.58 (cycle historical minimum).