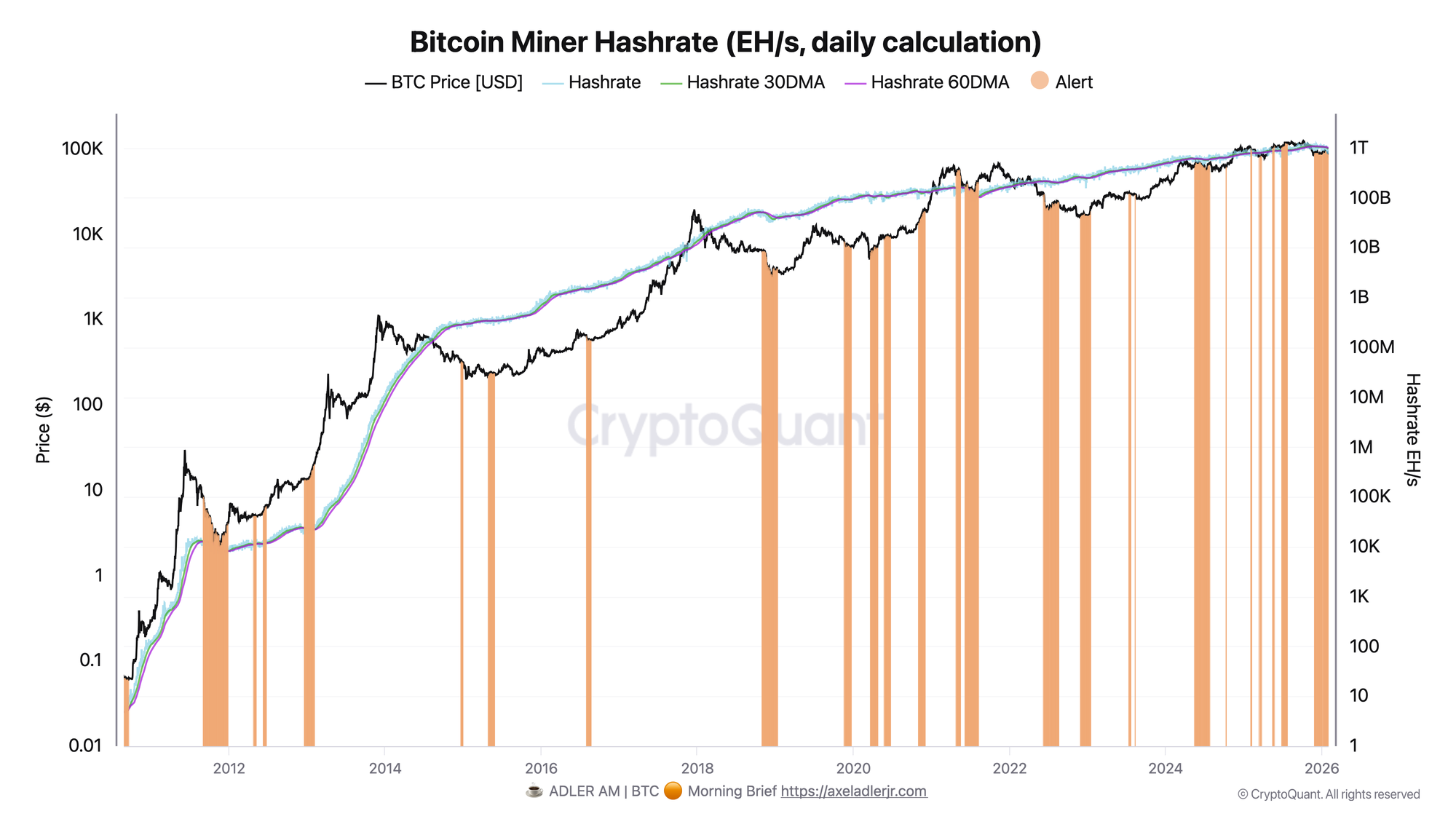

Hash Ribbons is a miner-stress indicator that uses hashrate momentum to spot capitulation and the recovery phase that often follows. When miners shut down unprofitable rigs, hashrate weakens, difficulty adjusts, and forced selling pressure can emerge - but the actionable edge is usually not the capitulation start, it’s the moment hashrate begins to recover. This guide gives you the exact 30/60-day rule, the buy trigger logic, and the best confirmation filters (like Puell Multiple) so you can use the signal as a disciplined accumulation framework rather than a one-shot bottom call.

TL;DR

- What it is: Momentum indicator comparing 30-day vs 60-day moving averages of Bitcoin hashrate

- Signal rule: 30DMA crosses below 60DMA = capitulation starts; crosses back above = buy signal

- Bullish/Bearish: Recovery crossover historically precedes rallies; capitulation start ≠ immediate bottom

- Key stat: ~64% of buy signals profitable since 2013, average return to cycle peak >5000%

- Caveat: Capitulation can last 4–12 weeks; price often drops further after signal starts

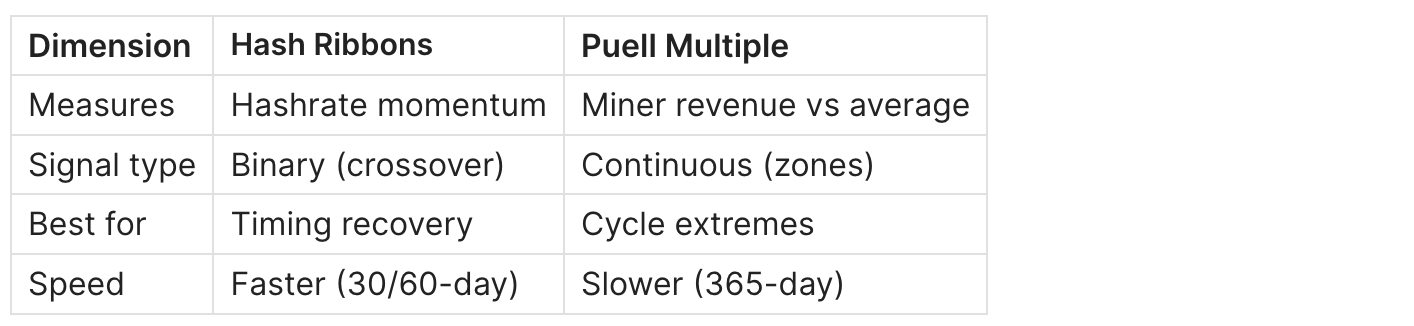

Confirmation: Combine with Puell Multiple < 0.5 for highest conviction

The Signal Rule

Capitulation signal (alert):

30-day MA of Hashrate < 60-day MA of Hashrate

Meaning: Miners shutting down, network under stress. NOT a buy — it's an alert.

Buy signal (action):

30-day MA crosses back ABOVE 60-day MA

+ BTC price momentum positive (10DMA > 20DMA)

Meaning: Weakest miners exited, selling pressure absorbed, recovery beginning.

Key Definitions

Hashrate: Total computational power (EH/s) securing the Bitcoin network.

Miner Capitulation: Period when unprofitable miners shut down, reducing hashrate. Triggers: price crashes, halvings, energy costs, regulatory bans.

30/60-day MA: Simple moving averages of daily hashrate. 30DMA = fast signal; 60DMA = baseline.

Buy Signal: 30DMA recovering above 60DMA with positive price momentum — created by Charles Edwards (Capriole Investments, 2019).

How to Interpret

Bullish: 30DMA crosses back above 60DMA after capitulation. Weakest miners gone, forced selling exhausted. Preceded rallies in 2015, 2019, 2021, 2023.

Bearish: 30DMA drops below 60DMA. Mining profitability declining, potential BTC reserve liquidation. Warning: NOT an immediate buy — capitulation lasts weeks/months.

Neutral: Both MAs rising with 30DMA > 60DMA. Healthy network, no actionable signal from Hash Ribbons.

What matters most: The recovery crossover timing, not the capitulation start. Trend > single day.

Historical Examples

Example 1: China Mining Ban (2021)

- Capitulation start: May 1, 2021 (BTC ~$57,855)

- Recovery signal: August 7, 2021 (BTC ~$43,550)

- What happened next: BTC rallied to $69,000 ATH by November (+58%)

- Duration: ~3 months of capitulation

Key insight: Even during unprecedented supply shock (regulatory, not price-driven), recovery signal correctly identified the turning point.

Example 2: Bear Market Bottom (2022)

- Capitulation start: June 7, 2022 (BTC ~$30,000)

- Price continued falling: To $17,500 (−42% after signal started)

- Recovery signal: August 19, 2022 (BTC ~$21,887)

- What happened next: Consolidation, then rally to $73,000 by March 2024

Key insight: Buy signal at $21,887 — not the exact $17,500 bottom. Hash Ribbons identify exhaustion, not perfect timing.

Example 3: Current Period (Nov 2025–Present)

- Capitulation start: November 25, 2025 (BTC ~$87,500)

- Current status (Feb 1, 2026): 30DMA = 967 EH/s | 60DMA = 1,013 EH/s

- BTC price: ~$78,000

- Recovery signal: Not yet triggered

Watch for: 30DMA crossing above 60DMA + price momentum confirmation.

How to Use It in Practice

Setup: Monitor Hash Ribbons via Bitcoin Magazine Pro or TradingView (indicator: "Hash Ribbons" by capriole_charles).

Trigger: 30DMA crosses back above 60DMA after being below.

Confirm with:

- Puell Multiple < 0.75 (miner revenue stress)

- MVRV Z-Score < 1 (undervaluation)

- Miner Reserve stabilizing

Invalidates when: 30DMA drops back below 60DMA shortly after crossover (failed recovery).

Action: Scale into position over 2–4 weeks. Use 30–50% on signal, remainder on price confirmation. Time horizon: 6–18 months.

Common Pitfalls

1. Buying on capitulation START

30DMA < 60DMA is the alert, not the buy. Wait for recovery crossover.

2. Expecting immediate reversal

Buy signals can precede consolidation. Treat as accumulation zone, use DCA.

3. Ignoring macro context

Hash Ribbons measure supply stress, not demand. Combine with MVRV for full picture.

4. Halving distortion

Post-halving hashrate declines are expected. Discount signals within 90 days of halving.

5. Over-reliance

~36% of signals unprofitable. Always confirm with Puell Multiple < 0.75.

Hash Ribbons vs Puell Multiple

Combined rule: Hash Ribbons buy signal + Puell < 0.5 = highest conviction accumulation.

FAQ

What triggers a buy signal?

30DMA was below 60DMA, then crosses back above, with positive price momentum.

How accurate historically?

~64% profitable (9/14 since 2013). Average holding ~253 days.

Where to track Hash Ribbons?

Bitcoin Magazine Pro, TradingView, Bitbo.io.

Is the current signal active (Feb 2026)?

Yes — capitulation since Nov 25, 2025. Recovery not yet triggered.

How long does capitulation last?

4–12 weeks average. China ban: ~3 months. Bear 2022: ~2.5 months.

Does it work post-ETF?

ETFs add demand-side variable. Combine with Puell for supply-side confirmation.

Related Guides

- Bitcoin Puell Multiple: Definition, Formula & Miner Signals — Big guide

- Miner Reserve & Outflow: Tracking Selling Pressure (coming soon)

- MVRV Z-Score Guide — Demand-side confirmation

Conclusion

- Hash Ribbons: buy on recovery crossover (30DMA > 60DMA), not capitulation start

- Historical accuracy ~64%; confirm with Puell Multiple < 0.75

- Current (Feb 2026): Capitulation active since Nov 25, recovery pending

Next step: Check the Puell Multiple for miner revenue confirmation.

Daily Analysis: Adler AM — Free weekly Bitcoin on-chain insights

Premium Research: Adler Premium — Institutional-grade reports

Disclaimer: Educational content only, not financial advice.