🎧 Morning Brief #0094 - audio debate on today’s market setup

The market was de-risking in advance - and after the Fed meeting, this dynamic had no reason to reverse. On-chain data on short-term holders (STH) confirms: capital is leaving the speculative segment, and sales are increasingly being locked in at a loss.

TL;DR

The Fed left rates unchanged, rhetoric remained hawkish - the market did not see a quick "pivot." Against this backdrop, STH Realized Cap continues to decline and has dropped below $600B (approximately $599.8B). The STH SOPR (90D) indicator remains below 1.0 (approximately 0.989), confirming that sales with realized loss remain the dominant behavioral pattern.

Macro Context: "Pause" Without Easing

January 28 the Fed kept rates in the 3.50-3.75% range. The key point for markets is not the pause itself, but the absence of a clear signal for imminent easing. In such an environment, high-risk assets typically struggle to retain capital inflows: investors demand either cheaper liquidity or a strong internal catalyst.

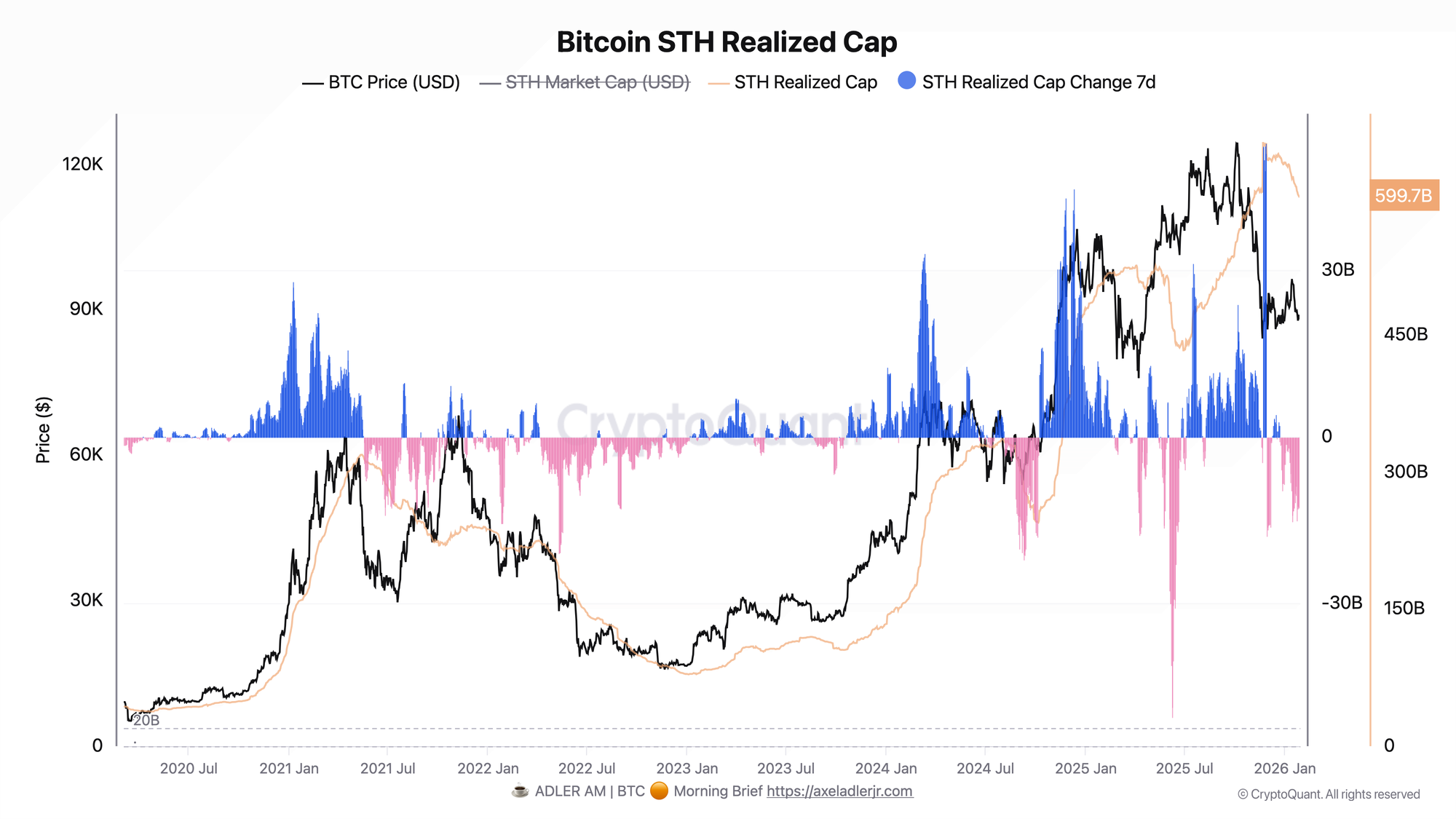

Bitcoin STH Realized Cap: Capital Leaving the Speculative Segment

Red Change 7d bars show that the decline did not happen "at the announcement moment" but developed in advance. Current capital reduction pace is around -$11.8 to -$15.0B per week. Since late December, the cumulative decline is approximately -$36B - this indicates a sustained rather than one-time exit wave.

What this means practically: demand from "fresh" capital is weaker, and any drawdown turns into selling pressure more quickly.

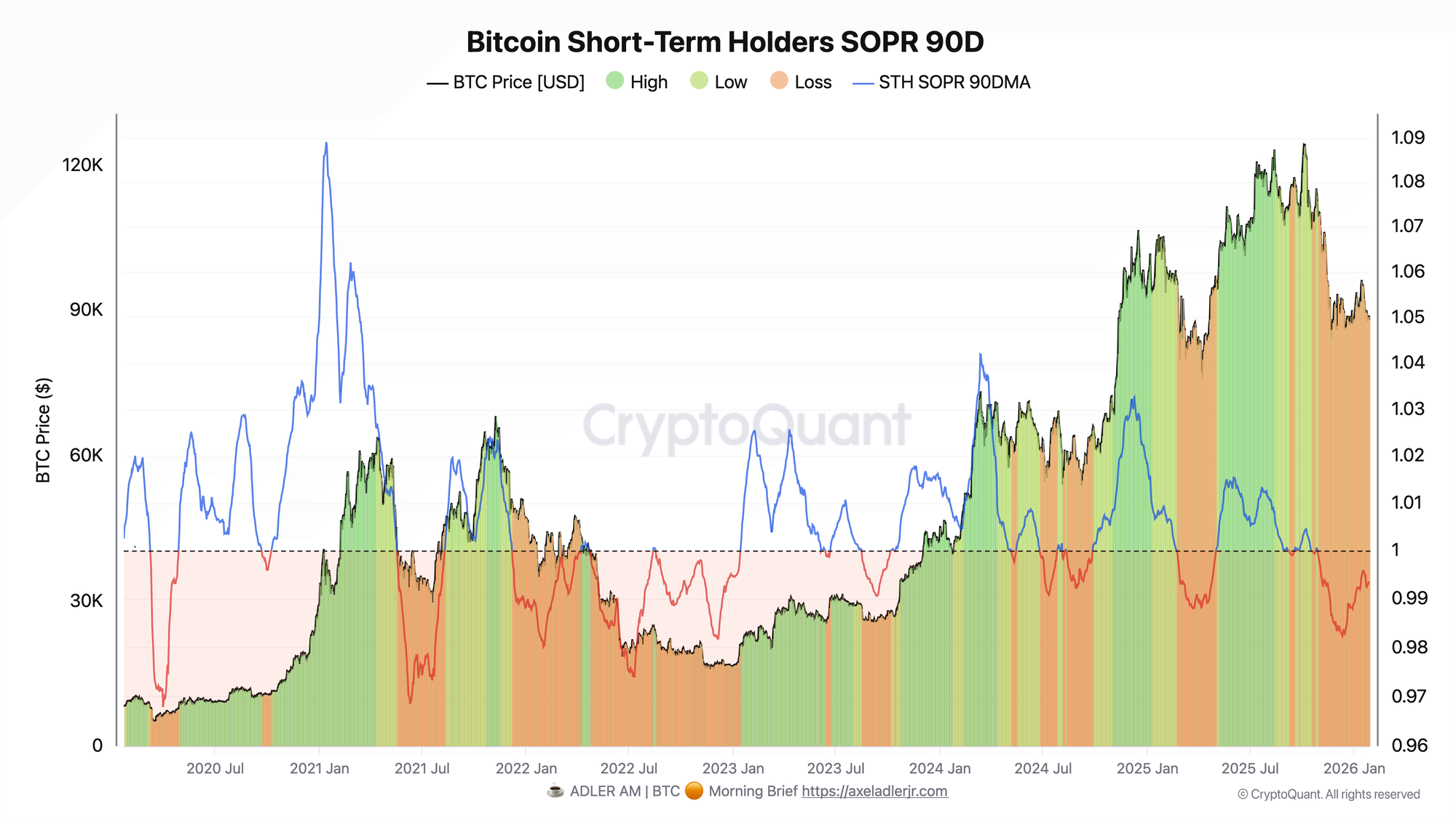

Bitcoin Short-Term Holders SOPR 90D: Loss-Taking Has Become the Norm

STH SOPR (90D) holds below 1.0 at approximately 0.989, and daily values are also more often below breakeven (approximately 0.989-0.998).

This matters more than it sounds: the market is not "testing" 1.0, it is living below it. This means some buyers from recent months are deciding to exit at prices below their cost basis, and this is typically accompanied by:

- increased sensitivity to negative news,

- accelerated selling on local pullbacks,

- elevated volatility until seller pressure is exhausted.

This brief is only part of the system.

Full access to the Biticon strategy and Deep Research is available in the 7-day trial.

FAQ

Why was the market weakening before the Fed decision?

Flows and metrics indicate gradual exposure reduction even before the meeting: falling STH Realized Cap and negative 7-day changes mean capital was exiting in advance. This is consistent with a "reduce risk first - then look for confirmation" regime.

What about price now?

As long as STH SOPR < 1.0 and STH Realized Cap continues declining, the market remains vulnerable to testing lower levels. A sustainable reversal typically requires one of two triggers: recovery of sales closer to breakeven (SOPR returns to 1.0 and holds above), or improvement in the macro backdrop (easing signal or another external catalyst).

Conclusions

The on-chain picture confirms a risk-off regime: short-term holder capital is contracting, and sales remain in loss territory. Additional context on market phases can be assessed through NUPL.