🎧 Morning Brief #102 - audio debate on today’s market setup

Bitcoin network difficulty dropped 14% over three weeks - one of the deepest correction episodes of the current cycle. Against the backdrop of deteriorating mining economics, Cango sold 4,451 BTC for $305 million over the weekend, citing "balance sheet strengthening." The Puell Multiple 30DMA fell below 0.8, while overall miner flows to exchanges remain stable. Three mining sector metrics and Cango's actions form a picture of hashrate capitulation: weak participants are shutting down, and some public players are transitioning to managed risk reduction, but there are no signs of panic at the systemic level yet.

TL;DR

Network difficulty dropped 14%, Puell Multiple 30DMA is below 0.8, and Cango sold 4,451 BTC - capitulation of inefficient miners is manifesting through hashrate decline, and pressure is beginning to affect some large public players. Meanwhile, systemic exchange flows remain stable: no mass reserve selloff is observed yet.

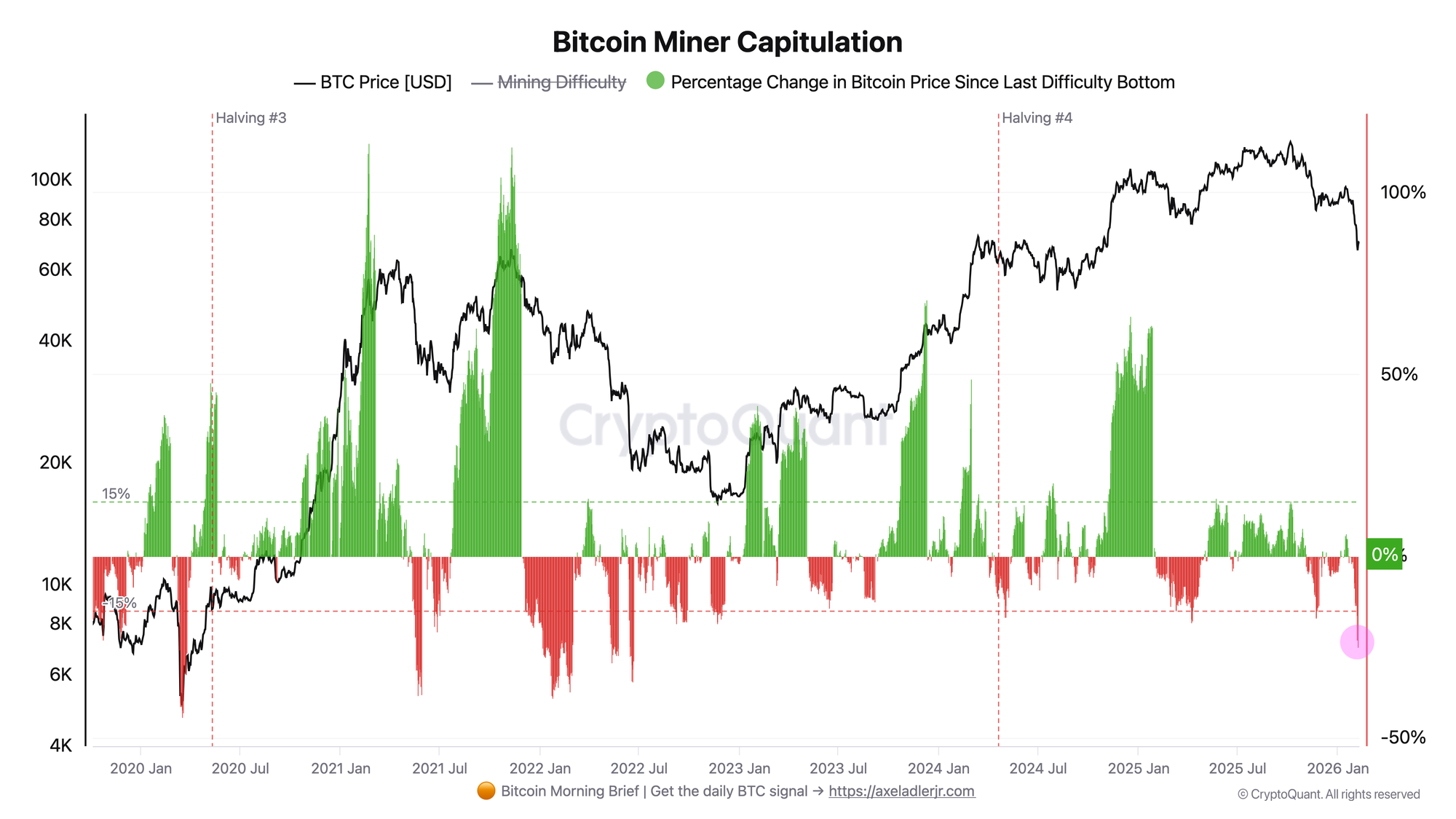

Bitcoin Miner Capitulation

From January 22 to February 6, price dropped 25%, and difficulty decreased twice during this period: first by 3.3%, then by 11.2%, totaling 14.1%. Two consecutive difficulty decreases are a classic capitulation marker when inefficient ASICs disconnect from the network. The last difficulty decrease occurred when price was around ~$70,300, and currently the market is trading near this level with less than 1% deviation.

The difficulty decrease means that some stress has already been realized through capacity shutdown, but confirmation of capitulation completion will only come with the next adjustment. The key trigger is price holding above $70,000 and difficulty growth beginning in the next cycle, which would confirm hashrate return and sector stabilization. A drop below $65,000 would extend pressure and could trigger a new round of shutdowns.

Headlines don’t tell you what to do.

The market is noisy and contradictory. Our system converts raw data into a clear weekly action - BUY, HOLD, REDUCE, or EXIT. → Start 7-day free access

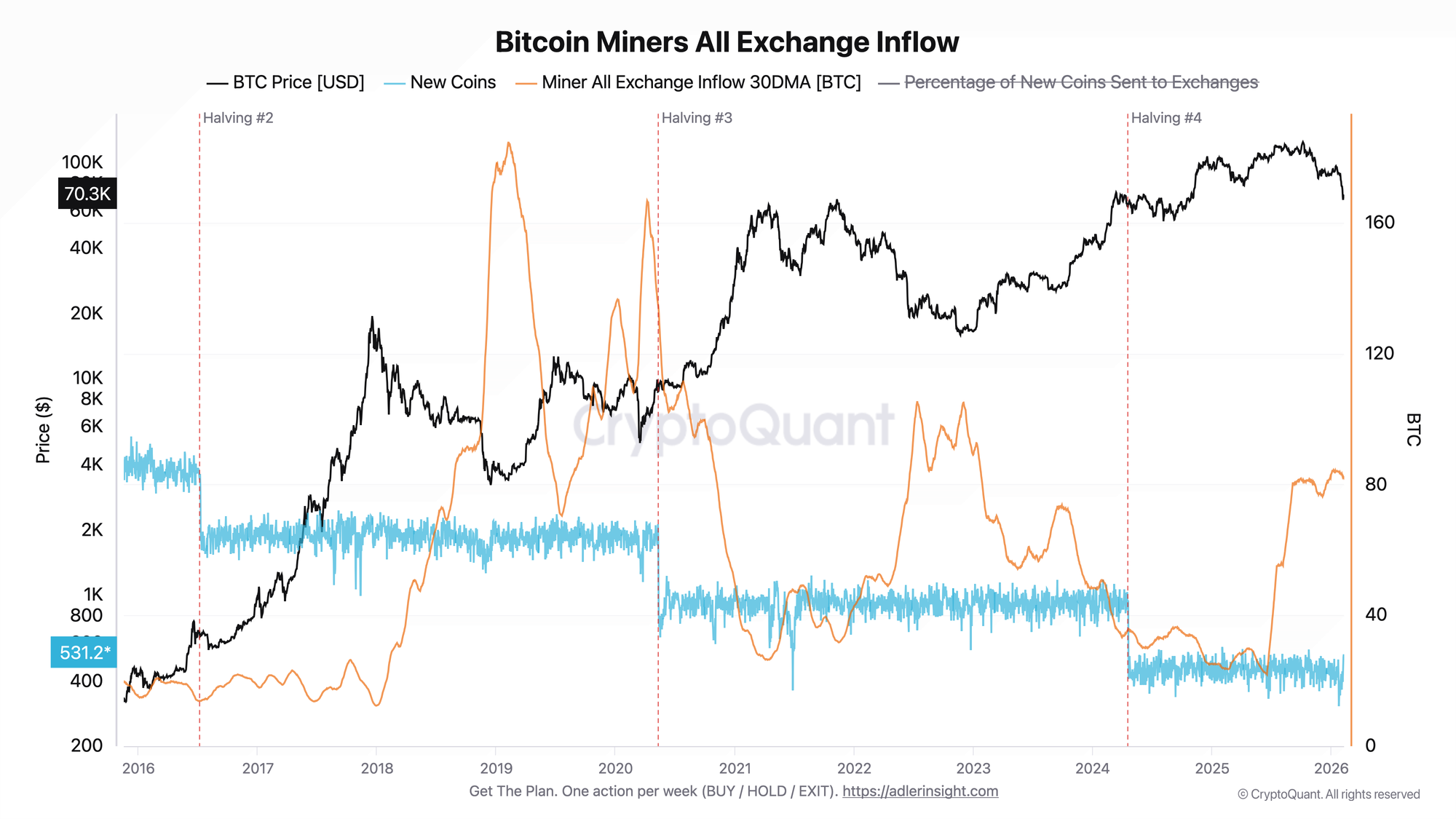

Bitcoin Miners All Exchange Inflow

The metric shows the daily volume of BTC sent from miner wallets to exchanges and the 30-day moving average of this flow.

Despite the price decline to $60,000, the SMA30 of miner exchange inflow decreased only slightly - from ~84 BTC to ~82 BTC per day. Daily values fluctuate in the 75-88 BTC range without extreme spikes. Against this backdrop, the Cango deal is notable: the company sold 4,451 BTC for $305 million, explaining it as necessary for balance sheet strengthening. The decision was approved by the board of directors after market analysis, but the market reacted negatively - Cango shares fell 8% on the first trading day after the news. The Cango deal is a point event, not a systemic signal: aggregated flows remain within normal operational activity, and large operators have not generally entered forced reserve liquidation mode.

Stable systemic flow during falling prices is a positive signal: the main stress is passing through capacity shutdown, not through aggressive coin dumping on exchanges. However, the Cango case shows that balance sheet pressure has already reached a level where some public miners are transitioning to managed sales. An alarming signal would be sustained daily inflow growth and SMA30 reversal upward, or similar sales appearing from other public miners.

Exchange flow data confirms the thesis of the first chart: capitulation in mining is manifesting through hashrate decline, not through mass reserve selloff. Cango is an exception for now, but an exception worth watching.

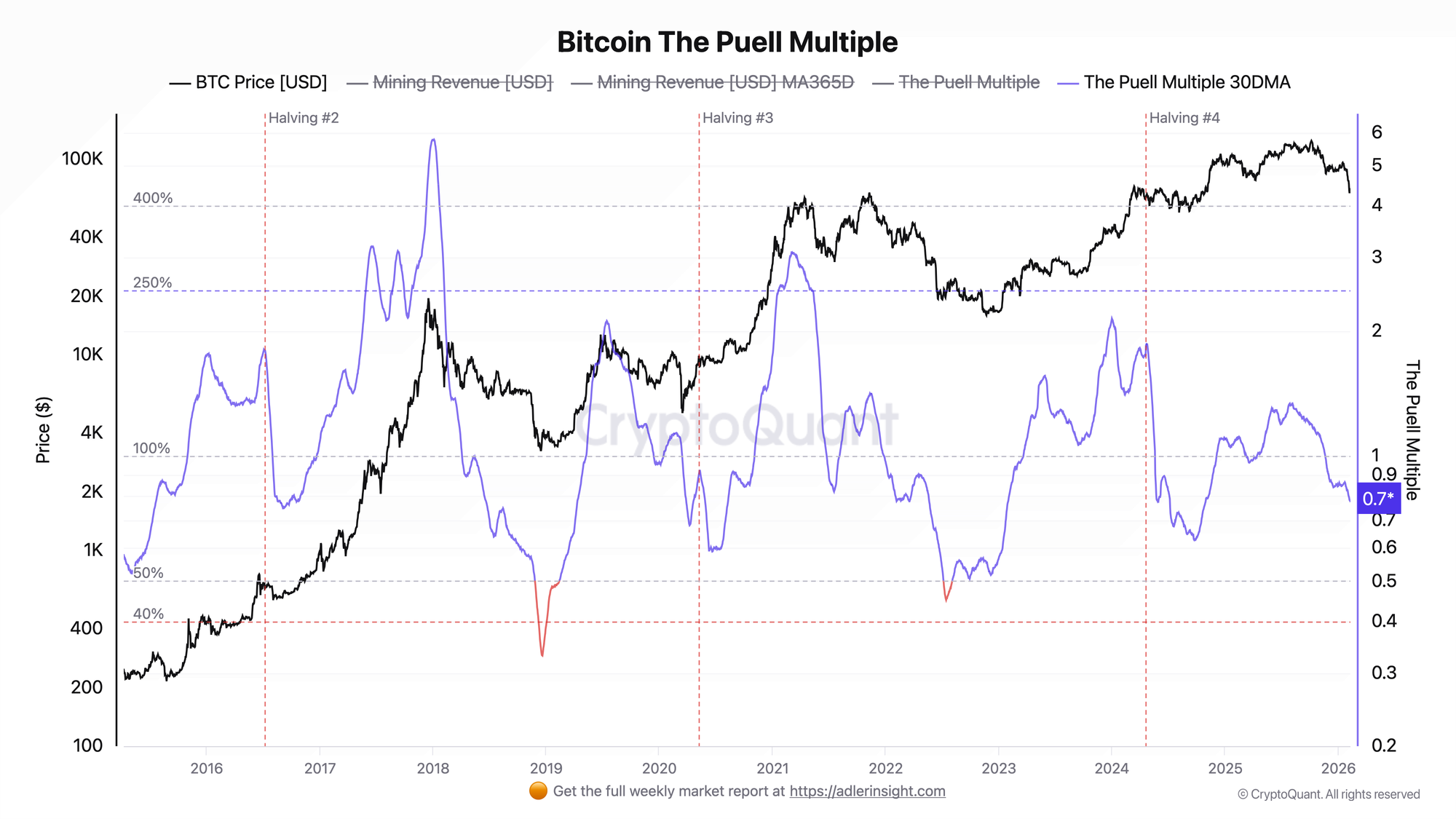

Bitcoin The Puell Multiple 30DMA

The Puell Multiple is the ratio of daily USD miner revenue to the 365-day moving average of that revenue. Values below 1.0 mean current revenue is below the annual average level.

The 30-day average Puell Multiple declined from 0.86 in mid-January to 0.77, while the spot value on February 5 dropped to 0.61 - the minimum in recent months. Sustained positioning below 1.0 confirms that miners are earning substantially less than the yearly average, and the 30DMA downtrend shows no signs of reversal yet. In this environment, preserving liquidity and reducing financial risk becomes the priority, increasing the probability of point reserve sales.

The 0.5-0.6 zone historically coincides with extreme capitulation phases and price bottom formation. The metric has already touched this zone, but the 30DMA still holds higher at 0.77. If the 30DMA reverses upward and returns to 0.85-0.90, this would confirm completion of the stress phase. Continued decline below 0.70 would indicate deepening profitability pressure and increase the probability of new large sales.

FAQ

What does a 14% difficulty decrease mean for the Bitcoin market?

A 14% difficulty decrease means that a significant share of hashrate has disconnected from the network because mining became unprofitable at current prices. This is a classic capitulation marker - weak participants exit, and remaining operators receive a larger share of revenue, gradually restoring industry economics.

Is the Cango sale the beginning of mass miner selloffs?

Not yet. Aggregated exchange flow data shows no anomalies - SMA30 is stable at ~82 BTC/day. The Cango deal was managed (board-approved) and motivated by balance sheet considerations, not forced liquidation. However, if Puell Multiple continues declining below 0.70 and price returns to the $60,000 zone, other public miners may make similar decisions.

Under what conditions can capitulation be considered complete?

Key completion triggers: difficulty growth in the next adjustment (hashrate return), Puell Multiple 30DMA reversal upward above 0.85, and stable exchange flows maintained without spikes. The combination of these signals would indicate transition from stress to recovery.

CONCLUSIONS

Three mining sector metrics form the following picture: difficulty dropped 14% (hashrate capitulation), Puell Multiple declined to 0.77 by 30DMA (profitability below annual average), exchange flows remain stable at ~82 BTC/day (no systemic panic selling). Cango's sale of 4,451 BTC ($305M) adds an important nuance to this picture: balance sheet pressure has already reached a level where some public miners are transitioning to managed risk reduction. The stock reaction (-8%) shows that the market perceives such actions as a stress signal. The current regime is a capitulation stage with signs of stabilization at the systemic level, but with point stress events at some large players. The main completion trigger is difficulty growth in the upcoming adjustment and Puell 30DMA reversal upward. The main risk is further price decline below $60,000, which could intensify profitability pressure and increase the probability of similar sales from other public miners, transforming managed stress into a broader selloff wave.