TL;DR

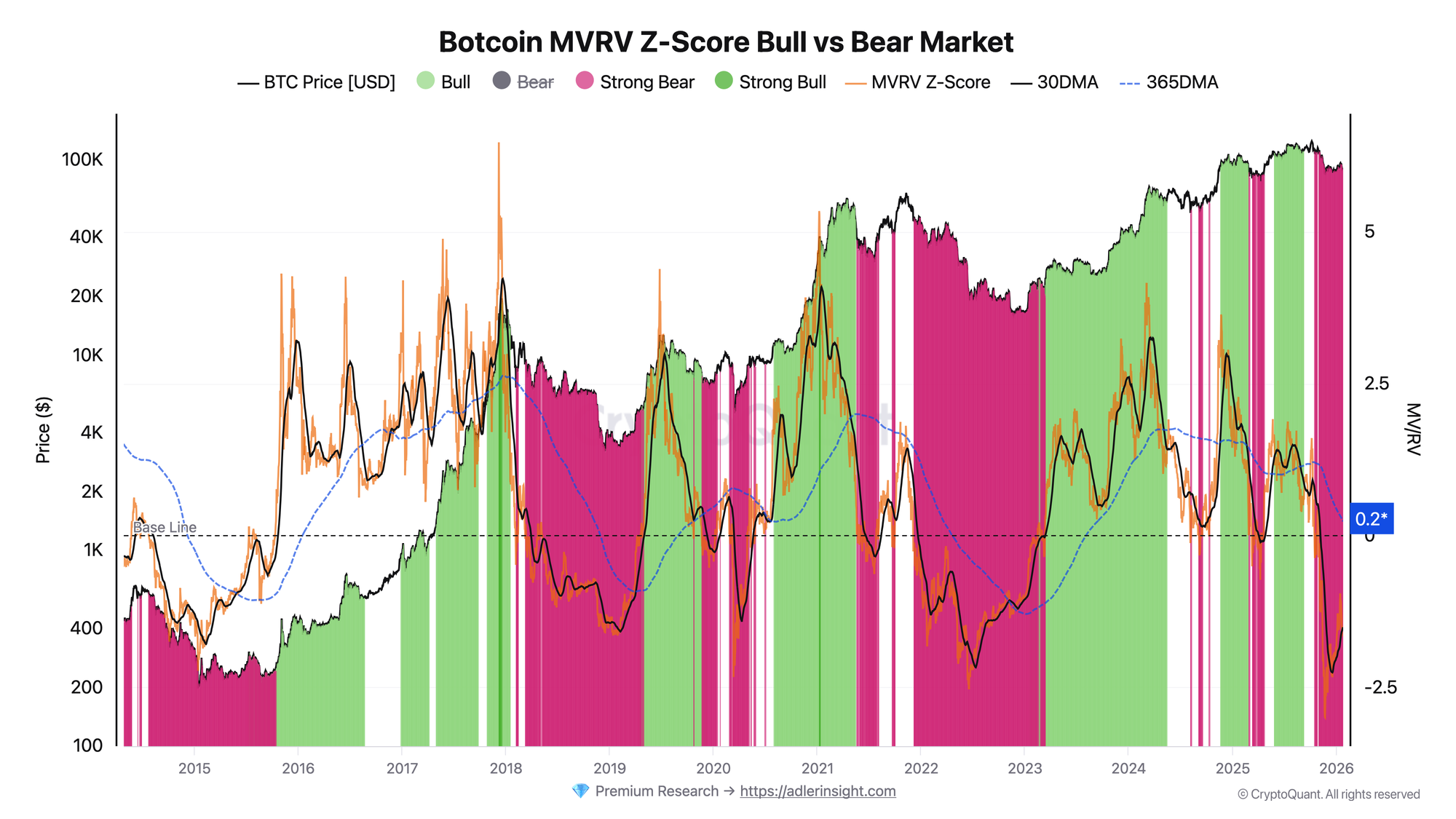

MVRV Z-Score measures how far Bitcoin's market value deviates from its realized value (aggregate cost basis), normalized by historical volatility.

- High Z-Score (>6) → overheating, distribution risk

- Low Z-Score (<0) → capitulation, accumulation opportunity

- Use as a risk zone tool, not a timing signal — always confirm with NUPL, STH SOPR, and Exchange Netflow.

What is MVRV Z-Score?

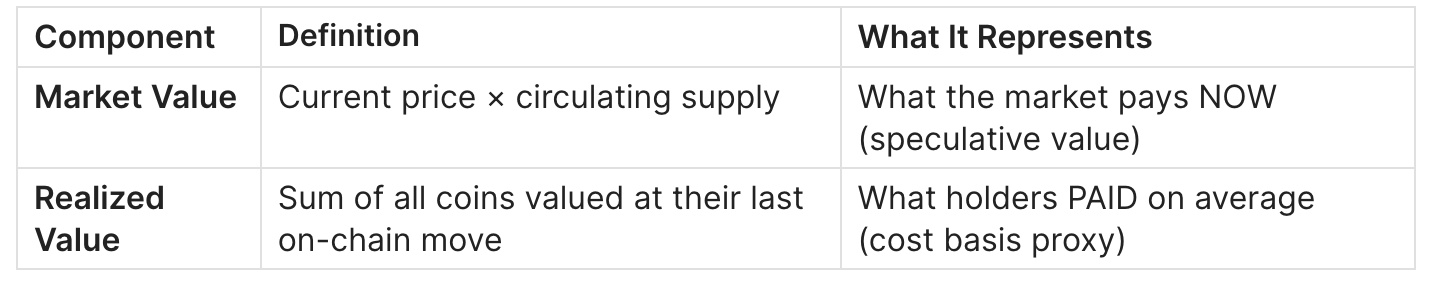

MVRV (Market Value to Realized Value) compares two fundamental valuations:

MVRV Z-Score normalizes this ratio using standard deviation, making it comparable across different market regimes and cycles.

Why Z-Score Matters

Raw MVRV can be distorted by:

- Regime shifts (spot vs leverage dominance)

- Long consolidation periods

- Lost coins inflating realized value baseline

Z-Score acts as a temperature gauge — it shows how extreme current conditions are relative to Bitcoin's entire history.

Origin

The metric was developed by Murad Mahmudov and David Puell, with further refinement by @aweandwonder. It became one of the most cited on-chain indicators for cycle analysis.

For the foundational MVRV Ratio explanation, see: Bitcoin MVRV Ratio: Definition, Formula & Cycle Signals

The Formula Explained

MVRV Z-Score = (Market Value - Realized Value) / StdDev(Market Value)

Breaking It Down

- Market Value - Realized Value = raw deviation between speculation and cost basis

- Standard Deviation = historical volatility measure

- Result = how many "standard deviations" away from normal

Interpretation:

- Z-Score of +3 means market value is 3 standard deviations above realized value

- Z-Score of -1 means market value is 1 standard deviation below realized value

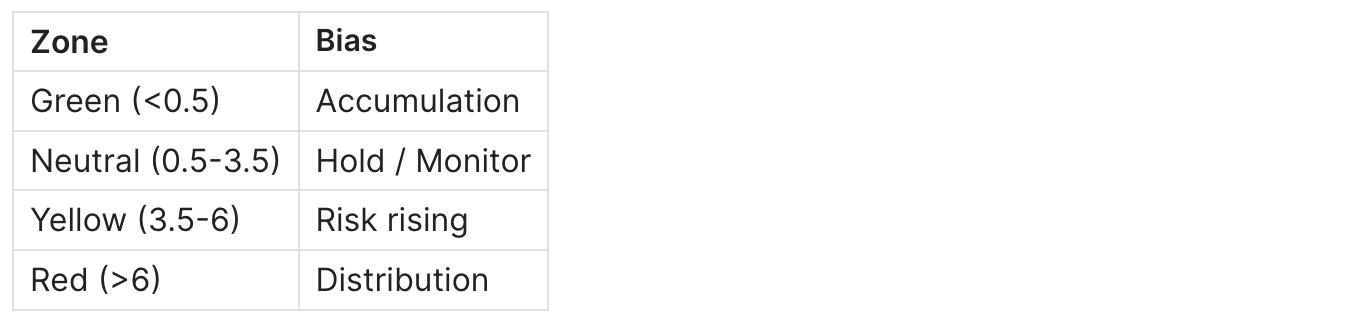

How to Read the Chart: Critical Thresholds

MVRV Z-Score provides risk zones, not precise timestamps. Markets can remain at extremes for weeks or months.

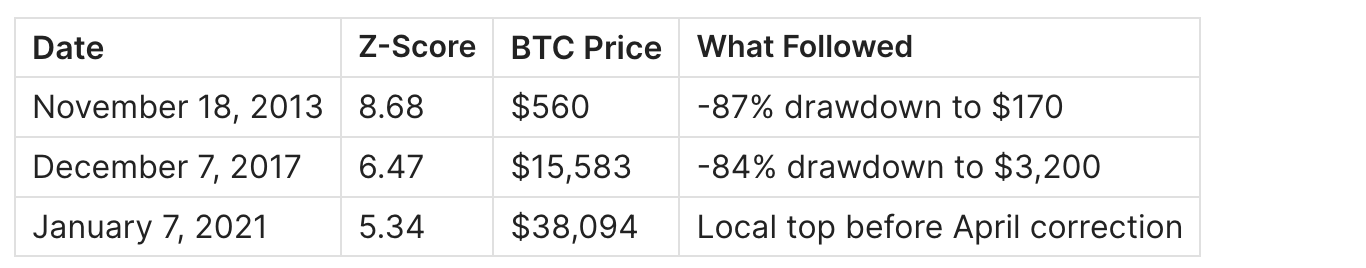

🔴 Red Zone (Z-Score > 6): Extreme Overvaluation

What happens in this zone:

- Most holders sit on large unrealized profits

- Distribution pressure builds

- Late-cycle demand becomes fragile

- Smart money begins scaling out

Historical Examples:

How to act:

- Do NOT "sell everything" — this is a zone, not a signal

- Shift to risk-off posture

- Scale out using confirmation signals (see framework below)

- Avoid adding leverage positions

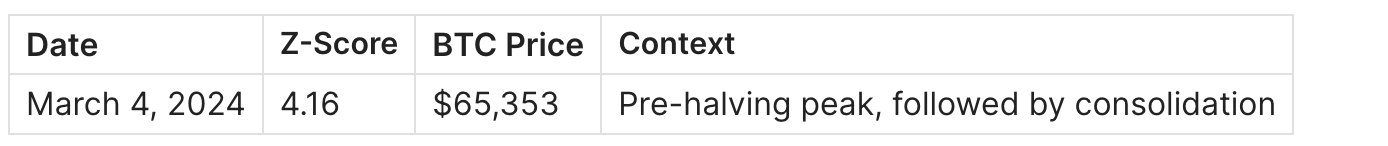

🟡 Yellow Zone (Z-Score 3.5 - 6): Elevated Risk

This is the distribution prep zone. Bull market can continue, but risk/reward degrades.

Characteristics:

- Price may grind higher

- Leverage and funding rates elevated

- Retail FOMO intensifying

- Smart money reducing exposure

Historical Example:

How to act:

- Keep core position but reduce marginal exposure

- Tighten risk management rules

- Avoid chasing breakouts without confirmation

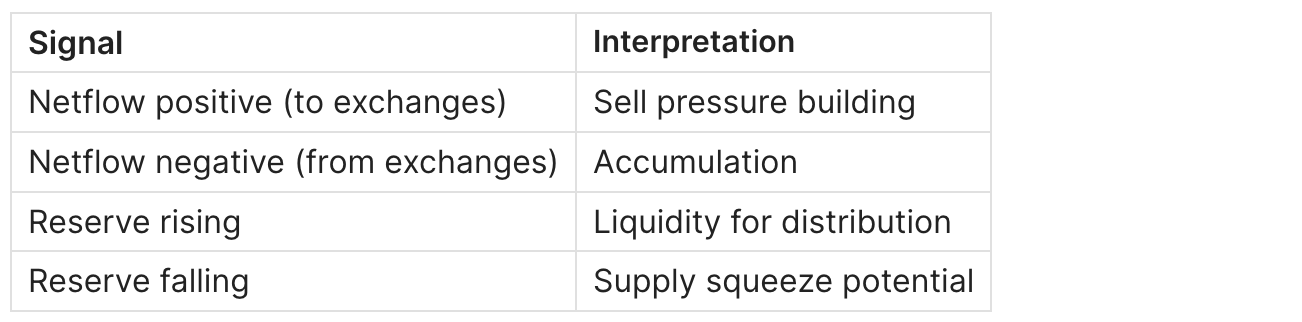

- Monitor Exchange Netflow for distribution signals

🟢 Green Zone (Z-Score < 0.5): Accumulation Territory

What happens in this zone:

- Broad unrealized losses across the market

- Low conviction environment

- Media sentiment negative

- Long-term opportunity zone

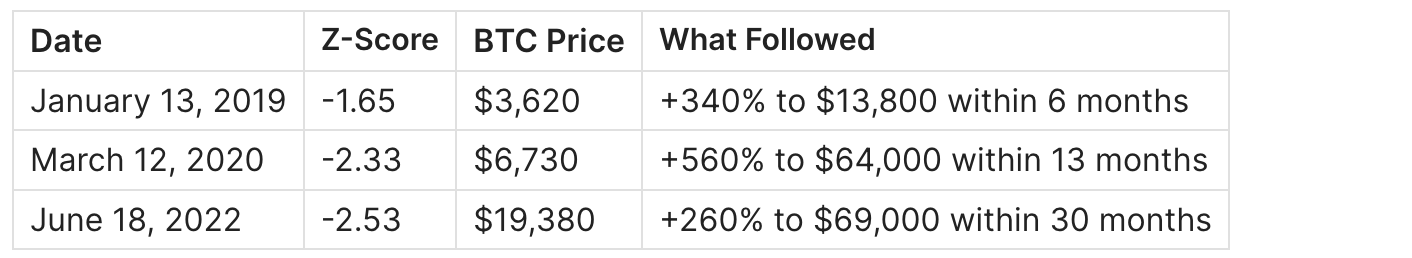

Historical Examples:

How to act:

- Allocate gradually (DCA approach)

- Focus on survival and long-term horizon

- Confirm with capitulation signals in NUPL

- Watch LTH vs STH dynamics for accumulation confirmation

Price vs Z-Score Divergence: Advanced Signal

One of the most powerful applications of MVRV Z-Score is identifying divergence between price action and on-chain valuation.

Bearish Divergence (Distribution Warning)

Pattern: Price makes higher highs, but Z-Score makes lower highs.

What it means: Market value is rising, but the rate of speculation relative to cost basis is declining. This suggests:

- New buyers are entering at higher prices (raising realized cap faster)

- Leverage may be driving price more than spot demand

- Distribution is occurring under the surface

Historical Example:

- Q4 2021: BTC price reached $69,000 (new ATH), but Z-Score peaked at 1.73 — far below the 5.34 reading from January 2021. This bearish divergence preceded the 2022 bear market.

Bullish Divergence (Accumulation Signal)

Pattern: Price makes lower lows, but Z-Score makes higher lows.

What it means: Market is finding support at higher valuation floors. Strong hands are accumulating despite price weakness.

Historical Example:

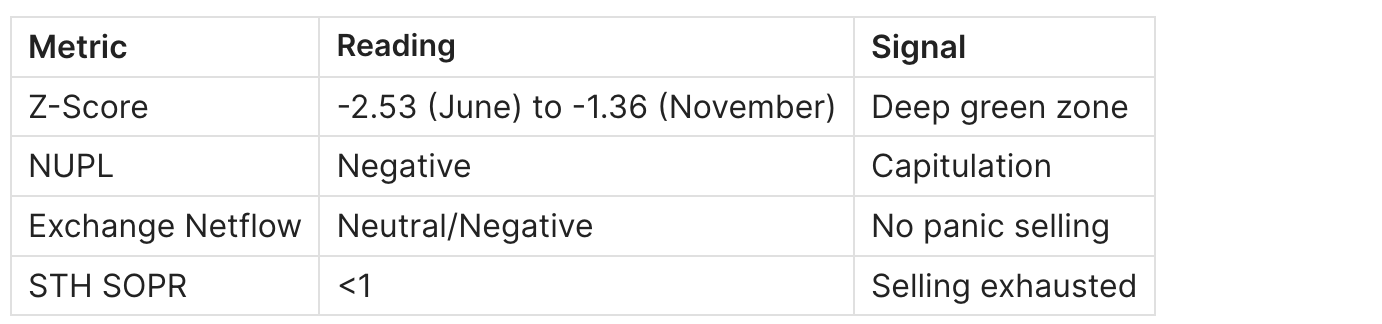

- Q3-Q4 2022: After the FTX collapse, BTC price made new lows around $15,500, but Z-Score (-1.36) was higher than the June 2022 bottom (-2.53). This bullish divergence signaled accumulation phase.

How to Use Divergence

- Identify price trend (higher highs/lower lows)

- Compare Z-Score peaks/troughs at same points

- Divergence = early warning, not immediate signal

- Confirm with NUPL and exchange flow changes

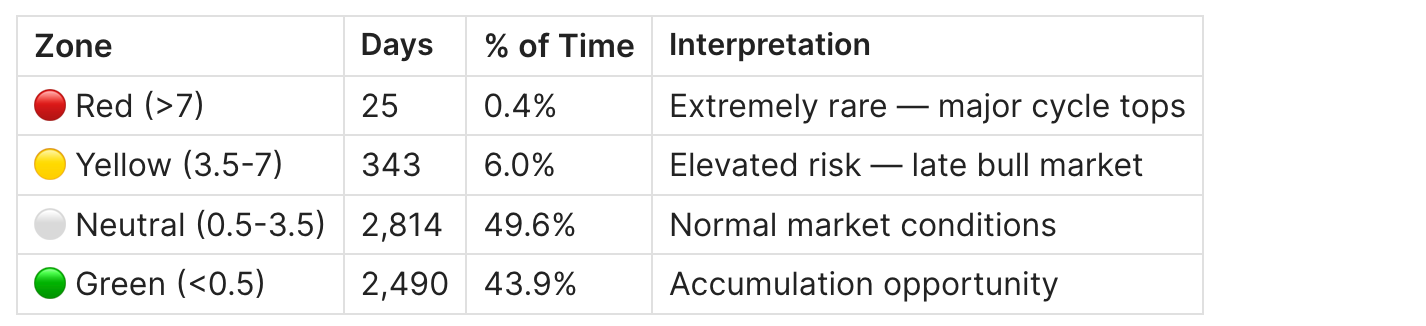

Historical Zone Distribution

Based on data since 2013:

Key insight: Bitcoin spends ~44% of its time in the green zone. Patience is rewarded.

Common Mistakes and Limitations

Mistake #1: Using Z-Score in Isolation

Z-Score alone cannot distinguish between:

- Healthy bull expansion

- Late-cycle overheating

- Temporary pullback vs regime change

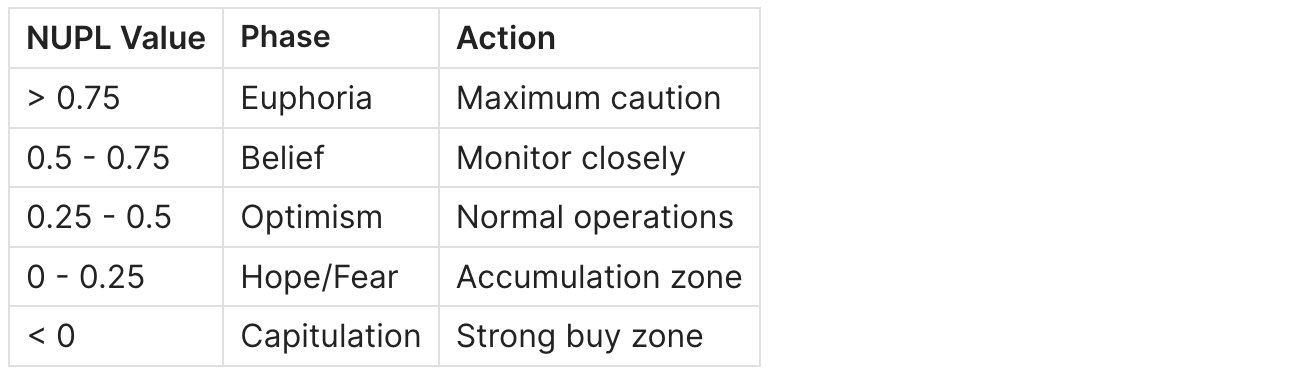

Fix: Always confirm with:

- NUPL — sentiment and profit regime

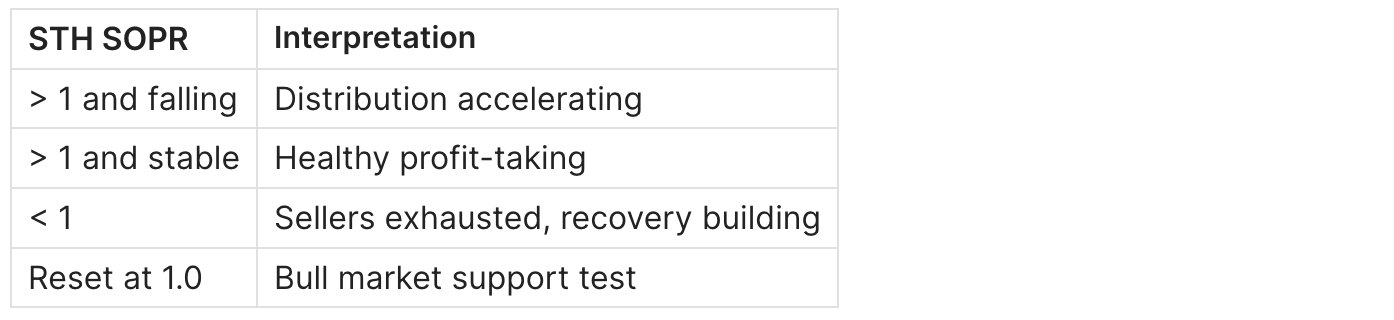

- STH SOPR — short-term selling pressure

- Exchange Netflow — distribution pathways

Mistake #2: Expecting Precise Timing

Z-Score can remain in extreme zones for weeks or months.

Example: In 2013, Z-Score stayed above 6 for over 30 days before the final top.

Fix: Use scale-out rules and confirmation triggers, not single-point exits.

Mistake #3: Ignoring ETF Impact (Post-2024)

Spot Bitcoin ETF approval changed market structure:

- New demand channel (institutional)

- Different flow patterns

- Potentially extended cycle duration

- Classic thresholds may shift

Fix: Add ETF context layer:

- Monitor ETF inflow/outflow alongside Z-Score

- Recognize that high Z-Score periods may last longer

- Adjust expectations for "new normal" in institutional era

Mistake #4: Lost Coin Bias

Permanently lost coins (~3-4M BTC) inflate the Realized Value baseline, affecting Z-Score calculations.

Fix: Treat Z-Score as a comparative risk tool, not absolute truth. Focus on direction and rate of change.

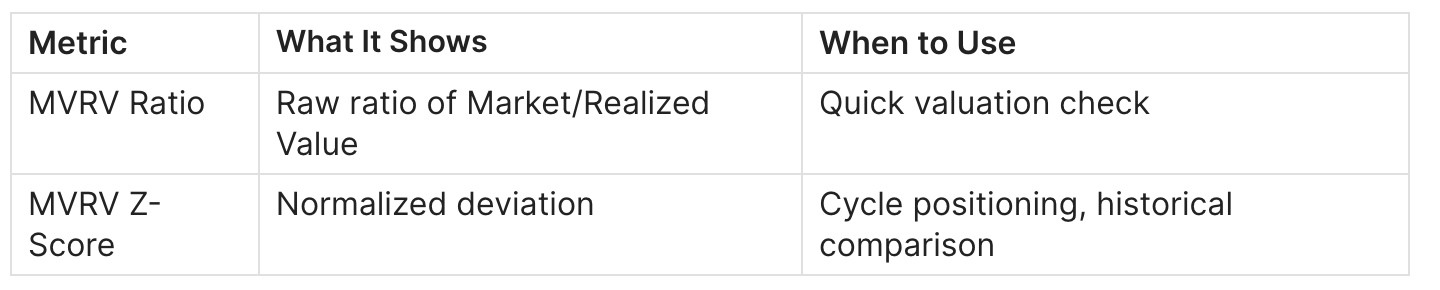

Mistake #5: Confusing MVRV and MVRV Z-Score

For detailed MVRV explanation: Bitcoin MVRV Ratio Guide

Advanced Variant: MVRV Z-Score 2YR Rolling

The traditional Z-Score uses Bitcoin's entire price history for standard deviation calculation. This includes extreme early-market volatility (2010-2013) that may distort modern readings.

The Problem

As Bitcoin matures:

- Volatility decreases

- Institutional participation changes market structure

- Early extreme data points become less relevant

This can cause traditional Z-Score to:

- Never reach classic "red zone" levels

- Show dampened signals in later cycles

The Solution: 2YR Rolling

Instead of full history, calculate standard deviation using only the previous 2 years of data.

Benefits:

- Better adapts to current market regime

- More responsive to institutional era changes

- Maintains accuracy for top/bottom identification

Tradeoff:

- Loses long-term historical context

- May show more false signals in short-term

Recommendation: Use both variants:

- Traditional Z-Score for long-term cycle positioning

- 2YR Rolling for current regime sensitivity

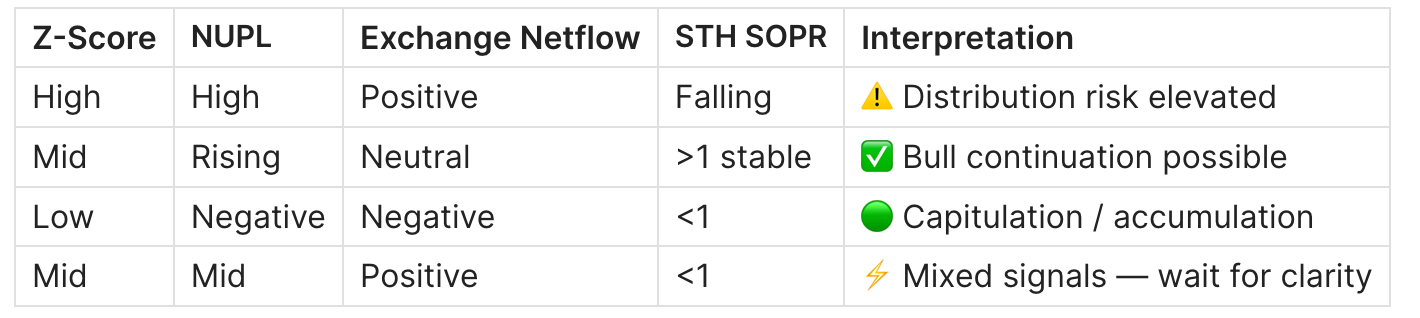

The Alpha: Multi-Indicator Confirmation Framework

Step 1: Identify Z-Score Zone

Step 2: Confirm with NUPL

See: NUPL Guide

Step 3: Validate with Exchange Flows

Step 4: Final Check with STH SOPR

See: STH SOPR Guide

Signal Matrix

Practical Application: Real Trade Examples

Example 1: Q4 2022 Accumulation

Context: Post-FTX collapse

Entry Logic: Scale-in over 2-3 months using DCA

Result: Entry around $16,000-20,000 → BTC reached $73,000 by March 2024 (+350%)

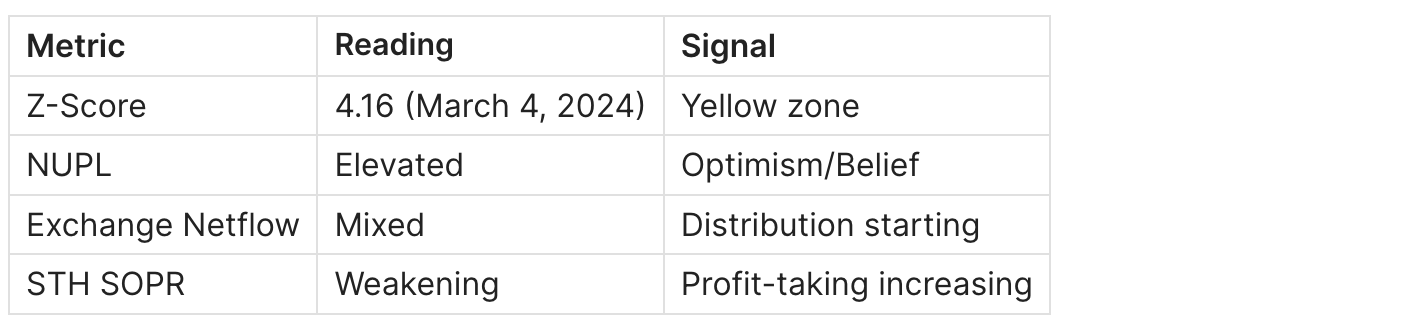

Example 2: Q1 2024 Elevated Risk

Context: Pre-halving rally, ETF approval euphoria

Action: Reduced leverage exposure, scaled out 20% of position

Result: BTC corrected from $65K to $56K (-14%) before halving

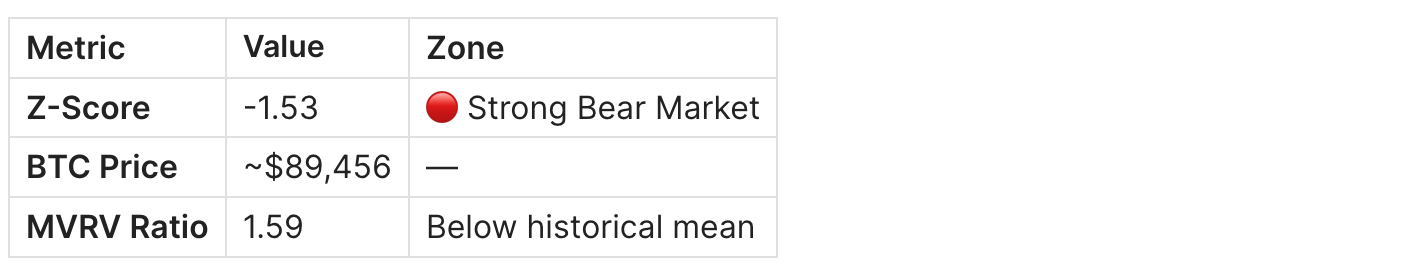

Current Market Context

Interpretation

Current Z-Score is in accumulation territory despite price being near all-time highs. This unusual divergence suggests:

- Realized Cap has grown significantly — cost basis of holders elevated

- Market structure shifted — ETF and institutional holdings changed dynamics

- Long-term holders absorbed supply — see LTH vs STH analysis

What to Watch

- NUPL recovery — shift from negative to positive signals sentiment change

- STH SOPR behavior — reset above 1.0 confirms bull support

- Exchange reserves trend — continued decline = bullish supply dynamics

- ETF flow persistence — sustained inflows = structural demand

Where to Track MVRV Z-Score

- Glassnode - Most comprehensive, professional grade

- CryptoQuant - Good alternative, strong derivatives data

- Bitcoin Magazine Pro - Good educational context

FAQ

What is a good MVRV Z-Score to buy Bitcoin?

Historically, Z-Score below 0 has marked strong accumulation opportunities. Values below -1 have preceded major rallies in every cycle since 2013. However, "good" depends on your time horizon — Z-Score of 0-1 may still offer reasonable entry for multi-year holders.

Has MVRV Z-Score ever given false signals?

Yes. Z-Score can remain elevated without immediate reversal. The 2013 cycle saw Z-Score above 6 for over a month. That's why confirmation from other metrics is essential. The best results come from combining Z-Score with NUPL, SOPR, and exchange flow analysis.

What's the difference between MVRV and MVRV Z-Score?

MVRV is a simple ratio (Market Value / Realized Value). Z-Score normalizes this using standard deviation, making it more reliable for cross-cycle comparison. Think of MVRV as raw temperature, Z-Score as "how unusual is this temperature for this time of year."

How often should I check MVRV Z-Score?

Weekly is sufficient for macro positioning. This is a long-term cycle indicator, not a day-trading tool. Checking more frequently may lead to overtrading and noise interpretation.

Can MVRV Z-Score be used for altcoins?

Not reliably. Altcoins have different liquidity profiles, shorter histories, and less robust on-chain data. The realized value concept is most meaningful for Bitcoin due to its UTXO model and long transaction history.

What does negative Z-Score mean?

It means Market Value is below Realized Value — the market is trading below aggregate cost basis. Historically, this is a strong accumulation signal that has preceded every major bull run.

Why doesn't Z-Score reach the same highs as previous cycles?

Several factors contribute to dampening cycle tops:

- Institutional involvement absorbs volatility

- Derivatives market redistributes speculation off-chain

- ETF flows create structural demand that wasn't present before

- Market maturity naturally reduces extreme deviations

Is current Z-Score reliable given ETF changes?

The metric remains valuable but requires contextual adjustment. ETFs don't directly affect on-chain realized value calculations, but they change demand structure and price discovery mechanisms. Use Z-Score alongside ETF flow data for complete picture.

Related Metrics

Build a complete on-chain framework with these complementary indicators:

- Bitcoin MVRV Ratio: Definition, Formula & Cycle Signals

- Bitcoin NUPL: What It Is and How to Use It

- Bitcoin STH SOPR: What It Is and How to Use It

- Bitcoin Exchange Netflow: What It Is and How to Use It

- Bitcoin LTH vs STH: Supply Dynamics & Market Structure

- Bitcoin Realized Price Bands Explained

Key Takeaways

- MVRV Z-Score is a risk zone indicator, not a timing tool

- Historical accuracy is high — every major cycle top and bottom since 2013 was marked by extreme Z-Score readings

- Never use in isolation — combine with NUPL, SOPR, and Exchange Flows

- ETF era may shift thresholds — classic levels need recalibration in institutional market

- Patience is rewarded — Bitcoin spends 44% of time in green zone